See also

23.06.2025 12:23 PM

23.06.2025 12:23 PMBitcoin was created as a way to preserve value in times of turmoil, especially against the backdrop of weakening fiat currencies. It was believed that the arrival of institutional investors would serve as a catalyst for a BTC/USD rally. In reality, neither the Israel-Iran conflict nor the growing interest from major players in digital assets managed to prevent the cryptocurrency from falling below the psychologically important $100,000 level.

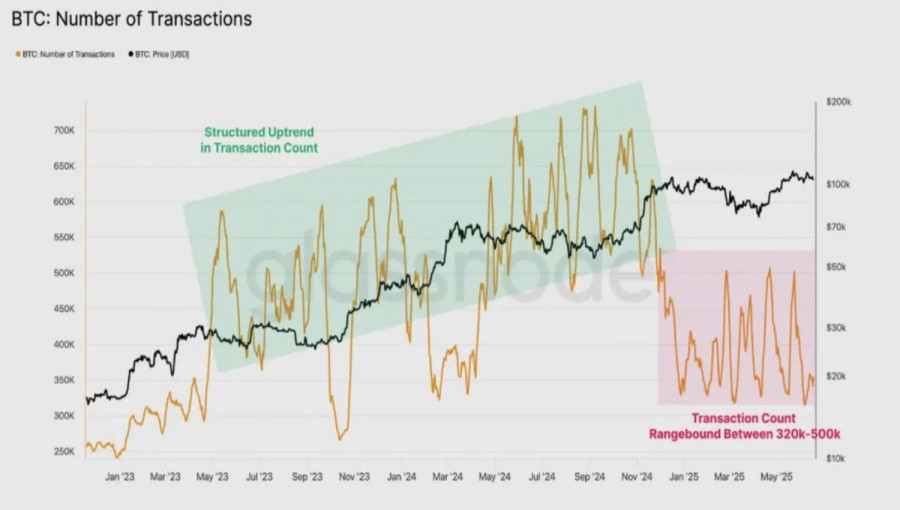

According to Glassnode, the number of transactions on the Bitcoin network has decreased from 600,000–700,000 in 2024 to 500,000 in 2025. At the same time, tokens worth over $7 billion are transferred daily. The increase in transaction size indicates the involvement of institutional investors in the market. This is also supported by the $131 billion inflow into Bitcoin ETFs since the approval of specialized exchange-traded funds in January 2024. Derivatives market activity has surged to $96 billion.

Bitcoin price and transaction volume trends

As a risky asset, Bitcoin's decline amid escalating geopolitical tensions in the Middle East may not come as a surprise. However, the different pace of decline between BTC/USD and the S&P 500 is noteworthy. While the broad stock index often ignored risks before the US attacks on Iran's nuclear facilities, Bitcoin responded sensitively to every escalation in the situation.

There's a view in the market that cryptocurrency shows extreme vulnerability to potential actions from countries under Western sanctions. Investors believe these nations, facing limited opportunities to sell traditional assets, turn to liquidating Bitcoin holdings. The resulting increase in token supply drives BTC/USD prices lower.

It should be noted that geopolitical conflicts typically have only short-term effects on the market value of various assets. For example, during the First and Second Gulf Wars, oil and US stock indices experienced wild swings. Both Brent crude and the S&P 500 eventually returned to their prior levels relatively quickly.

History may well repeat itself in the case of the Israel-Iran conflict. Much will depend on Tehran's response. Iran has stated that Donald Trump started this war, and it will be the one to finish it. Markets fear the closure of the Strait of Hormuz and a surge in Brent crude to $120 per barrel. In such a scenario, the likelihood of a BTC/USD correction significantly increases. On the contrary, if the descendants of the Persians deliver only a symbolic retaliation, investor interest in crypto could return.

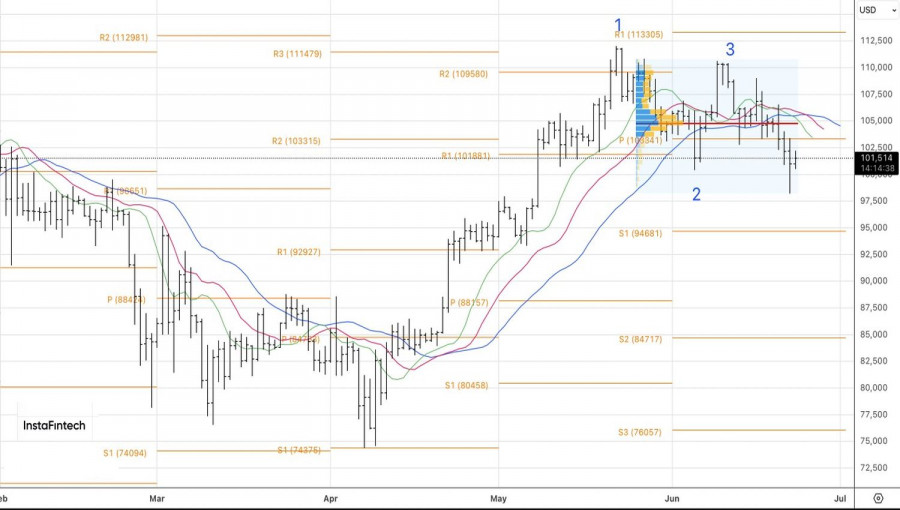

Technical outlook

On the daily chart, a clear 1-2-3 pattern has been formed. Until quotes return to the resistance level at 103,350 and the fair value at 104,750, it makes sense to hold short positions initiated from 105,000 and even consider increasing them. Conversely, a successful breakout would signal a reversal and a shift to long positions on BTC/USD.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.