See also

25.06.2025 12:22 AM

25.06.2025 12:22 AMDonald Trump has a remarkable ability to draw market attention. One moment, the U.S. President imposes massive tariffs on Independence Day; the next, he announces a 90-day delay. He reports a ceasefire between Israel and Iran, then accuses both sides of violating it. However, one theme remains consistent in the Republican's actions: his criticism of Jerome Powell. And now, EUR/USD is becoming more sensitive to this than to events in the Middle East.

It seemed the issue was settled. Donald Trump acknowledged that he doesn't want to fire Powell from his position as Fed Chair. Investors concluded that the occupant of the White House would wait until the central bank chief's term ends, then replace him with someone more loyal. Current Treasury Secretary Scott Bessent was even mentioned as a potential candidate. However, it now appears members of the FOMC are entering the fray.

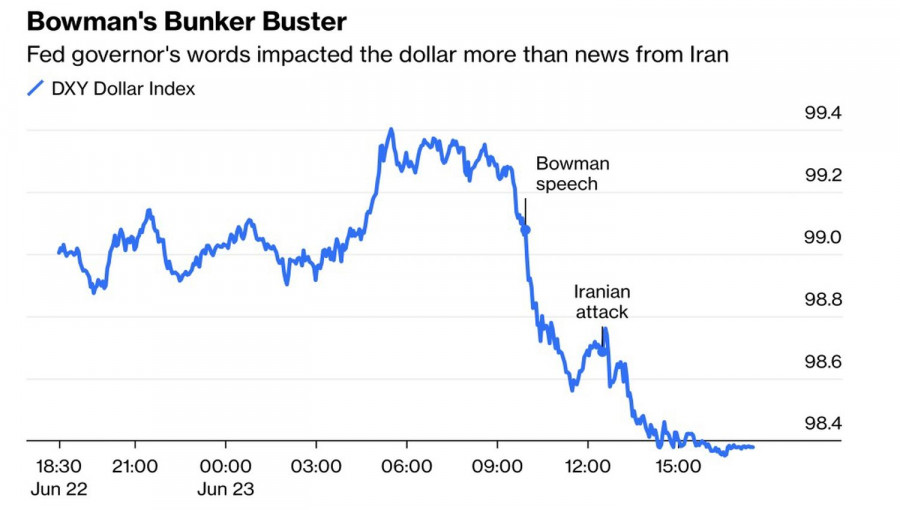

First, Christopher Waller and then Michelle Bowman surprised investors by stating their readiness to support a federal funds rate cut in July. Bowman's comments, in particular, shocked the markets. Just back in September, she firmly rejected supporting aggressive monetary easing. Now, she's voting in favor of monetary expansion at a time when most other FOMC officials prefer to remain on the sidelines. Jerome Powell states in his prepared remarks to Congress that the Fed should wait. Without clarity on the final scale of tariffs, it's better to take no action.

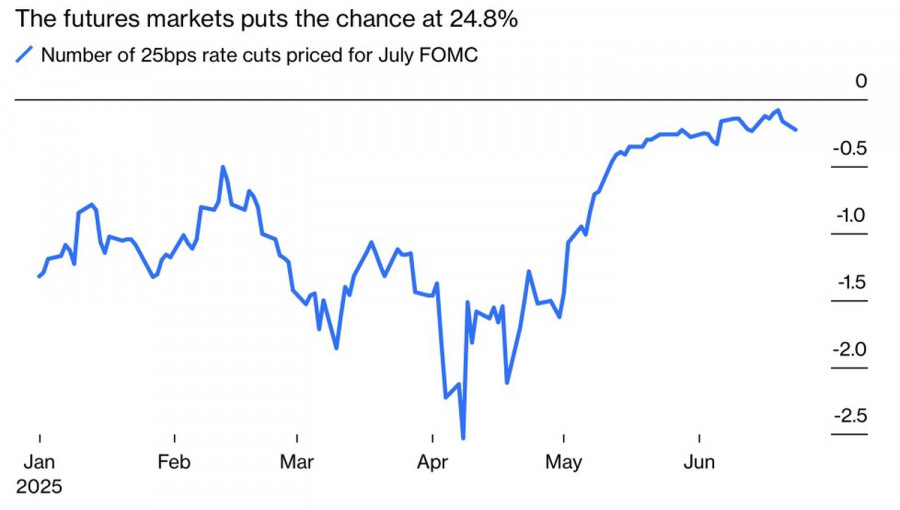

Naturally, this doesn't sit well with Trump, who calls for a 200–250 basis point cut in borrowing costs. The U.S. President claims that due to Powell's incompetence, America will pay a heavy price. Trump hopes Congress will deal with this "stupid and stubborn man." For now, markets place more trust in the Fed Chair. Derivatives are pricing in only two acts of monetary expansion by the end of 2025 and harbor no illusions about easing in July.

Trump isn't alone in criticizing Powell. Kevin Hassett, Chair of the Council of Economic Advisers, sees no reason for the Fed not to lower rates immediately. He hopes that fresh data from the past month will compel the central bank to resume the cycle of monetary expansion. Commerce Secretary Howard Lutnick echoed this sentiment, saying the current borrowing costs make no sense. "Enough! It's time to lower them!"

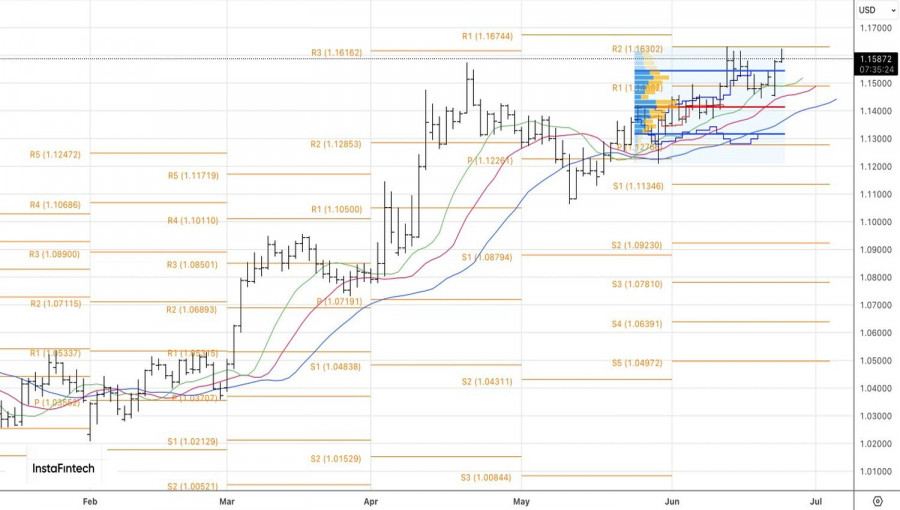

Technically, on the daily EUR/USD chart, there has been a breakout above the upper boundary of the fair value range at 1.1315–1.144. As long as quotes remain outside this range, buyers will dominate. Pullbacks or a breakout of the pivot level at 1.1625 should be seen as opportunities to build long positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.