See also

25.06.2025 08:44 AM

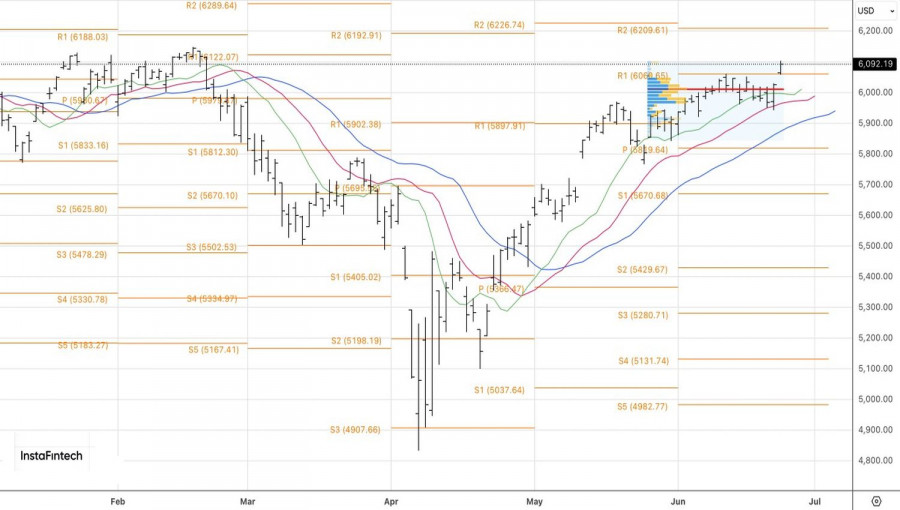

25.06.2025 08:44 AMNeither the story of China's DeepSeek, the White House tariffs, nor the Israel-Iran conflict could halt the victorious advance of U.S. stock indices. The Nasdaq 100 has already updated its record highs amid a renewed surge in interest in artificial intelligence technologies. The S&P 500 is now within arm's reach of its all-time highs. The stock market consistently overcomes challenges while aiming high.

The de-escalation of the Middle East conflict became another reason to buy the broad market index. Iran's retaliatory strikes on U.S. military bases were symbolic in nature, and Donald Trump forced both Jerusalem and Tehran to fall silent. The twelve-day war rattled financial markets, but as expected, the geopolitical conflict was short-lived. Oil prices returned to previous levels, and investors who bought the S&P 500 during the dip are now in the money.

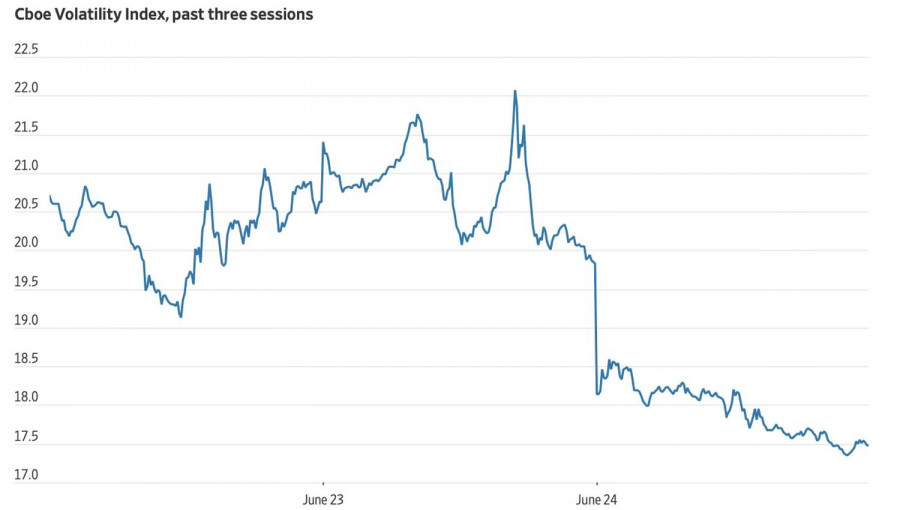

Fear has subsided, and greed has returned to the markets—as evidenced by the decline in the VIX volatility index.

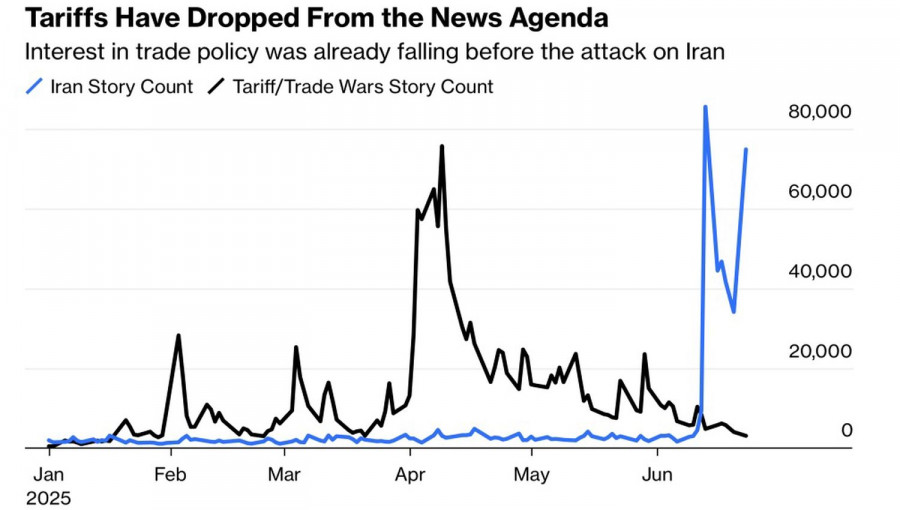

Investors are confident that the ceasefire will gradually lead to a complete resolution of the conflict, and they are beginning to shift their focus to other developments: the state of the U.S. economy, Federal Reserve monetary policy, corporate earnings, artificial intelligence technologies, and trade wars.

As long as the U.S. economy remains strong, inflation continues to slow, and Wall Street experts forecast a 2.8% increase in earnings per share for S&P 500 companies in Q2, the broad index can look to the future with optimism. This is especially true since Jerome Powell did not rule out an earlier-than-expected cut in the federal funds rate—provided inflation continues to ease and the labor market freezes.

Gradually, investor focus is shifting back to trade wars. Tensions are mounting as the 90-day White House tariff delay approaches its expiration. The U.S. has failed to reach an agreement with the EU, which is preparing retaliatory measures worth $116 billion if tariffs on U.S. imports rise to Trump's previously announced 50% level.

The massive tariffs announced on America's Independence Day once pulled down the S&P 500. Will this time be different? The broad stock index feels supported by the President and his team. The rhetoric of the U.S. administration often matters more to equities than macroeconomic data releases.

In my opinion, traders have adapted to buying the S&P 500 on dips. Even if the White House escalates trade wars, the broad market index is unlikely to fall significantly.

Technically, on the daily chart, the bulls have taken another step toward restoring the uptrend in the S&P 500. The all-time high is within reach, and there are fewer and fewer doubts that it will be surpassed. Previously opened long positions should be maintained. Targets are set at 6200 and 6400.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.