See also

26.06.2025 09:19 AM

26.06.2025 09:19 AMThe markets continue to be dominated by the theme of Iran-Israel negotiations, previously initiated by the United States. Whether actual agreements are reached or not will have a noticeable impact on asset prices—beyond just oil prices. However, this issue is not the only one weighing on investors.

Iran and Israel's negotiators are scheduled to meet next week. The suspension of active military conflict is not a final solution, meaning that a breakdown in talks would inevitably lead to a resumption of hostilities. It is unlikely that the parties are doing nothing to prepare for a potential failure of the negotiation process.

While the issue of escalation in the Middle East has temporarily faded into the background, investors have once again turned their full attention to another unresolved issue brought forth by Donald Trump—customs tariffs. This problem hasn't gone away, and with the 90-day deadlines concerning China, the EU, and other countries approaching, it is returning to the forefront. This shift is reflected in the movement of the dollar exchange rate and gold prices, the latter of which traditionally serves as a safe-haven asset in times of instability.

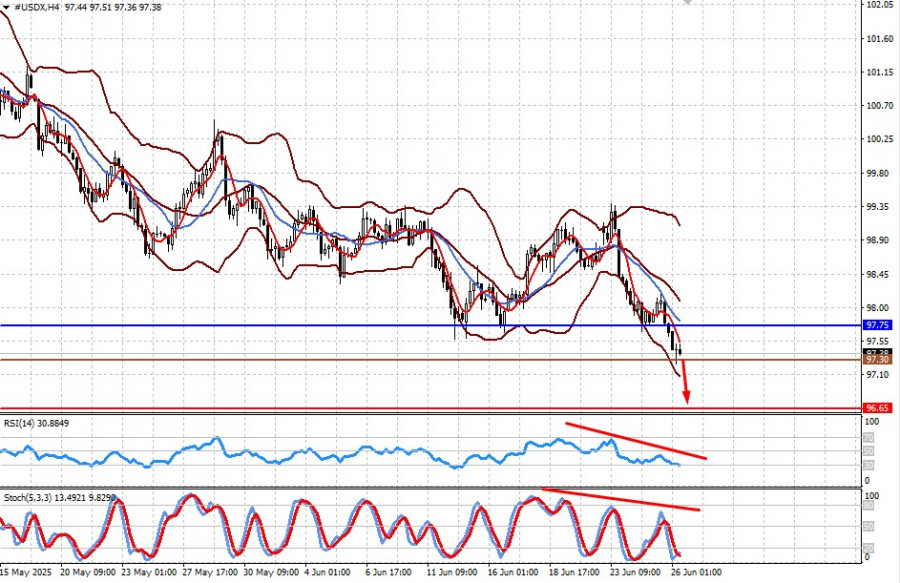

After a brief period of stabilization in the dollar's exchange rate against a basket of major currencies—and even a modest recovery—the easing of Middle East tensions has redirected investor attention back to the underlying weakness of the U.S. currency. As a result, the dollar index has fallen below the strong support level of 97.75 and is moving toward a new support level of 96.65. The key drivers of this weakness remain the same: elevated risks of continued GDP contraction, which has once again turned negative for the first time since 2022. One must also factor in the uncertainty surrounding the economic impact of the trade war initiated by Trump shortly after taking office. This trade issue is central to the dollar's underlying weakness.

If today's revised U.S. Q1 GDP figures align with expectations—projected at -0.2% versus +2.4% in the previous period—pressure on the dollar will likely intensify in the Forex market, pushing major currencies traded against the dollar higher.

Due to the suspension of hostilities in the Middle East, demand for equities is likely to persist. However, the continued presence of this issue as a high-risk factor will exert pressure on the markets, particularly on the dollar and oil prices. Tokens and gold will likely receive support.

The dollar index will likely continue to decline amid the general fundamental weakness of the U.S. currency. In this environment, a drop to 96.65 is expected. The 97.30 level may serve as an entry point for selling.

The pair has fallen below the support level of 144.50. Dollar weakness will likely contribute to further declines in line with the overall sideways trend. The 144.30 level may serve as a point to enter short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.