See also

27.06.2025 09:16 AM

27.06.2025 09:16 AMGreed has returned to the markets. While professionals warn about the need for caution amid geopolitical uncertainty, trade wars, and the state of the U.S. economy, retail investors are once again behaving as if they are unbridled. According to JP Morgan, after a brief lull, they bought $3.2 billion worth of U.S. stocks in the five days leading up to August 25. This has brought the S&P 500 within arm's reach of its all-time high.

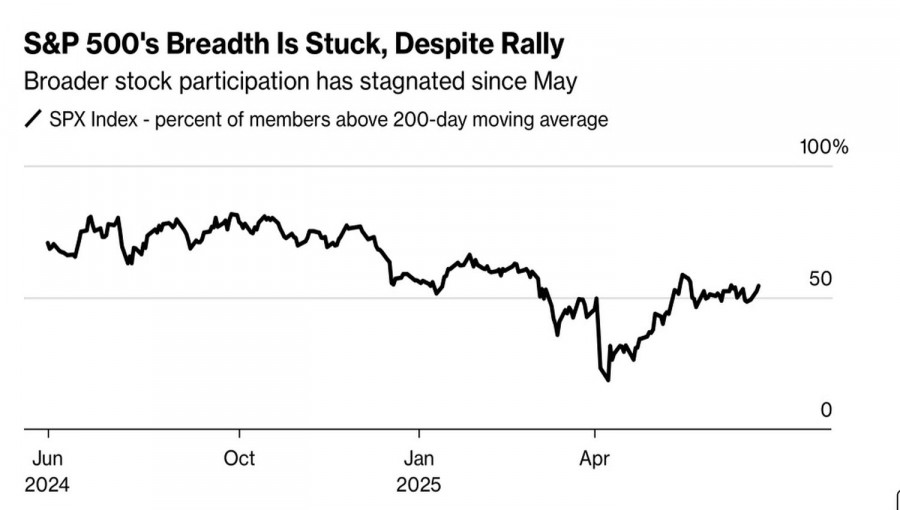

Overvalued fundamentals and shallow market breadth are the reasons professionals prefer to stay on the sidelines when it comes to the broad equity index. The proportion of S&P 500 companies trading above their 200-day moving average has remained unchanged for an extended period. This suggests that a narrow group of issuers is driving the market — led by the tech giants.

Amazon and Meta Platforms have announced substantial investments in artificial intelligence, and NVIDIA surprised investors with its expansion into cloud computing. Traders are expecting growth in corporate earnings, and combined with the Federal Reserve's readiness to ease monetary policy at least twice in 2025 and a still-resilient U.S. economy, this is giving a strong boost to the S&P 500.

In the four remaining FOMC meetings this year, the Fed may cut rates two or even three times. As early as July, two officials may vote to resume the monetary easing cycle — something that hasn't happened in 32 years. Such a division within the Fed would increase the likelihood of imminent stimulus, further strengthening the tailwinds for the S&P 500.

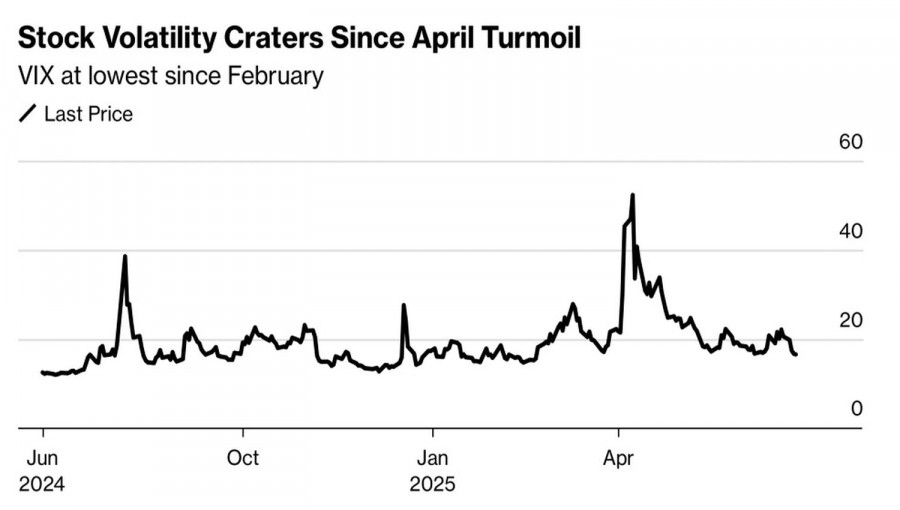

The White House is doing everything it can to support this rally. The U.S. administration has indicated that the tariff deferral period may be extended. Commerce Secretary Howard Lutnick has announced upcoming trade deals between the U.S. and 10 major countries. All this is fueling greed. FOMO grips the market — fear of missing out on profitable opportunities — while the VIX volatility index continues to decline.

Professionals caution that the current FOMO resembles behavior typically seen in the final stages of a bull market. But no one is listening. Ultimately, big players were selling in April, while retail investors were buying the dip. And it's the latter who came out on top. Since the spring bottom, the S&P 500 has gained 23%, and the Nasdaq 100 — 32%. Tech stocks were in deep decline back then, but now they're shining — despite signs of a cooling U.S. economy.

The third estimate showed a 0.5% contraction in GDP for the first quarter. The trade deficit has widened, and continuing jobless claims have surged to their highest level since 2021. But when greed rules the market, such details are easily overlooked.

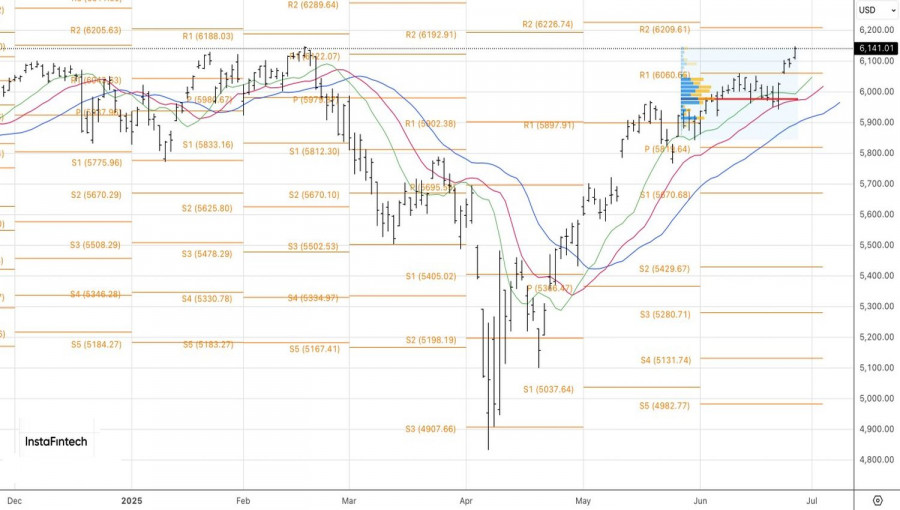

Technically, on the daily chart, the S&P 500 bulls are ready to set new all-time highs. A breakout above the February peak at 6144 would allow them to add to current long positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.