See also

03.07.2025 10:40 AM

03.07.2025 10:40 AMThe market has ignored extremely weak employment data from ADP, focusing its attention on other factors.

The ADP report released on Wednesday showed a significant slowdown in the U.S. private sector. Instead of a modest increase in new jobs, it recorded a decline of 33,000 in June, compared to the expected growth of 99,000. Equally important was the downward revision of May's figures to just 29,000.

Why did the market, particularly the U.S. market, ignore the negative ADP report? In my opinion, there are three main reasons:

First, when the U.S. economy slows down and this affects the labor market, the Federal Reserve almost always begins to cut interest rates. The logic is that businesses need support to create new jobs. From this principle stems a classic market rule often summarized as "the worse, the better." This means that the worse the situation—here, in the labor market—combined with relatively low inflation, the higher the likelihood that the Fed will resume rate cuts, potentially as early as September this year. Market participants view this as a long-term positive and therefore buy stocks, resulting in new highs for the three major indexes.

Second, the push by Donald Trump to increase the budget deficit and reduce taxes for businesses in Congress is expected to stimulate economic activity and support demand for corporate stocks.

Third, Trump's pressure on trade partners has led to preferential deals for the U.S., easing global tariff tensions. This removes a major uncertainty that had been hanging over investors like a "looming threat" for the past six months, preventing them from assessing how the tariff saga would end.

Today is a short trading day in the U.S. ahead of Independence Day, so market activity is likely to be lower due to the absence of American investors.

Overall, I believe that the current positive momentum in stock markets will continue. Gold may receive support due to ongoing tensions in the Middle East, although significant price increases are unlikely. The cryptocurrency market, after a local uptick in demand, may enter a consolidation phase again. The U.S. dollar index will likely move sideways below the 97.00 level. Crude oil prices may resume gradual growth amid optimism about a global economic recovery following the end of the trade war period.

The cryptocurrency is effectively consolidating within a wide range of 99,000.00–110,000.00. On the price chart, a trend continuation pattern — a "descending flag" — has formed, which, if realized, could lead to a price increase toward 111,986.00 after breaking above 109,713.00. The buy level could be around 109,955.00.

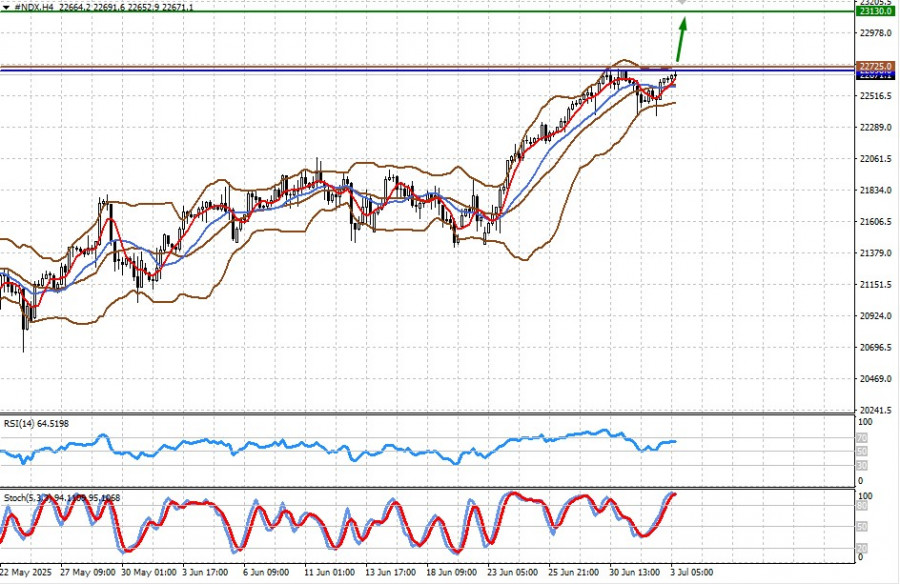

The CFD contract on the NASDAQ 100 futures is trading just below the local high of 22,698.00. A breakout above this level, amid ongoing positive market sentiment, could lead to a rise toward 23,130.00. The buy level could be around 22,725.00.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.