See also

07.07.2025 12:14 PM

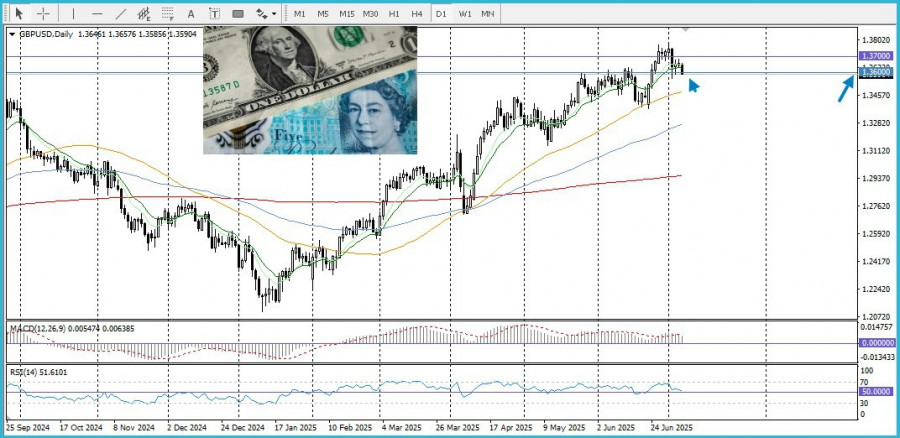

07.07.2025 12:14 PMThe GBP/USD pair began the new week attempting to hold the key psychological level of 1.3600. However, amid mixed fundamental factors, it has not been successful so far.

The British pound received support after Prime Minister Keir Starmer announced that Chancellor Rachel Reeves would remain in her post. However, the growing likelihood of a Bank of England rate cut as early as August is weighing on the pair. Remarks by Bank of England Governor Andrew Bailey regarding a possible rate cut, along with MPC member Alan Taylor's call for faster easing due to risks to the UK economy, have strengthened expectations of monetary policy easing.

At the same time, the decline in GBP/USD is being softened by weakness in the U.S. dollar. Investors are concerned about a potential rise in the U.S. federal deficit and mounting debt issues amid President Trump's large-scale tax and budget initiatives. Strengthening expectations that the Federal Reserve will resume its rate-cutting cycle in the near future are keeping the dollar at 2022 levels.

Today and tomorrow, in the absence of significant economic data from the UK and the U.S., market volatility is expected to remain low. On Wednesday, attention should turn to the FOMC meeting minutes, which may provide important signals regarding the future direction of the Fed's interest rate policy and impact demand for the dollar, and thus the dynamics of the GBP/USD pair.

From a technical perspective, mixed oscillators on the daily chart—along with the Relative Strength Index dropping below 50—indicate weakening bullish momentum. On lower timeframes, oscillators have already moved into negative territory, suggesting an intraday decline in the pair.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.