See also

11.12.2025 09:17 AM

11.12.2025 09:17 AMYesterday, gold prices rose for the third consecutive day after the Federal Reserve announced the widely anticipated rate cut. Silver also soared to record highs. The price of gold increased by 0.5% and approached the mark of $4,248 per ounce, as treasury yields and the dollar declined following the last FOMC meeting of the year.

The US central bank lowered interest rates for the third meeting in a row, maintaining the probability of only one rate cut in 2026. It is worth noting that the Fed's dovish stance favorably impacts precious metals, which typically benefit from low interest rates since they do not pay interest.

Despite the cautious stance of the Fed, investors seem to interpret this as a signal for further monetary easing in the future, which has spurred demand for gold as a hedge against inflation and currency instability. Given the ongoing geopolitical tensions worldwide and the uncertainty around economic growth prospects, the appeal of gold as a safe asset is only increasing.

In addition to gold, silver is also showing impressive dynamics, soaring to record heights. Silver's dual role as a precious metal and an industrial commodity makes it particularly attractive in the current economic environment. On one hand, like gold, silver serves as a protective asset during periods of economic uncertainty. On the other hand, rising demand for silver in industries such as solar energy and electronics supports its price.

Experts predict that the rally in precious metals could continue into next year, especially if the Fed maintains its dovish monetary policy. However, it is essential to remember that the precious metals market can be volatile, and investors should exercise caution when making investment decisions.

This year, gold has appreciated by more than 60%, while silver has more than doubled, with both metals showing their best annual performance since 1979. This rapid growth has been supported by active purchases from central banks and capital flows from government bonds and currencies. According to the World Gold Council, investment volumes in gold-backed exchange-traded funds have increased every month this year, except for May.

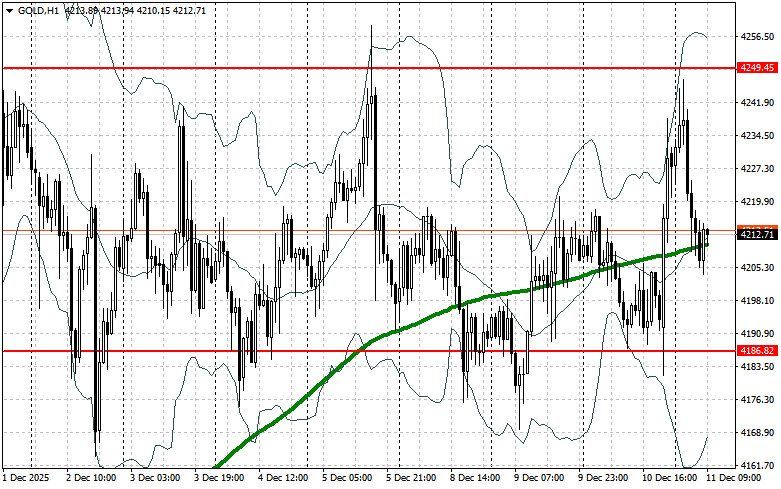

Buyers need to target the nearest resistance at $4,249. This will allow them to aim for $4,304, above which it will be quite challenging to break through. The furthest target will be around $4,372. In the event of a drop in gold prices, bears will try to take control at $4,186. If they succeed, a breakout below this level will deal a significant blow to bullish positions and push gold down to a low of $4,126, with the potential to reach $4,062.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.