See also

17.02.2026 12:34 AM

17.02.2026 12:34 AMDonald Trump's selection of a new chair for the Federal Reserve has shown that dollar pair dynamics are affected not only by macroeconomics but also by specific individuals. Just recall how Kevin Warsh's name impacted the crash of gold prices. The market received a more hawkish figure than expected, which led to a stronger dollar. Before this, it fell due to concerns that a pronounced dove would lead the central bank. A similar situation is currently unfolding in Europe, contributing to the dynamics of EUR/USD.

Given the developments on the political stage in France, the EU's drive to quickly find a replacement for Christine Lagarde, who is set to step down in 2027, seems logical. Emmanuel Macron is likely to lose to Marine Le Pen or another right-wing candidate in the elections, and these concerns are unsettling Brussels. Just as the appearance of a shadow chair at the Fed in the U.S. could impact the mid-term outlook for EUR/USD, the arrival of a dove or hawk at the top of the European Central Bank could also have significant effects.

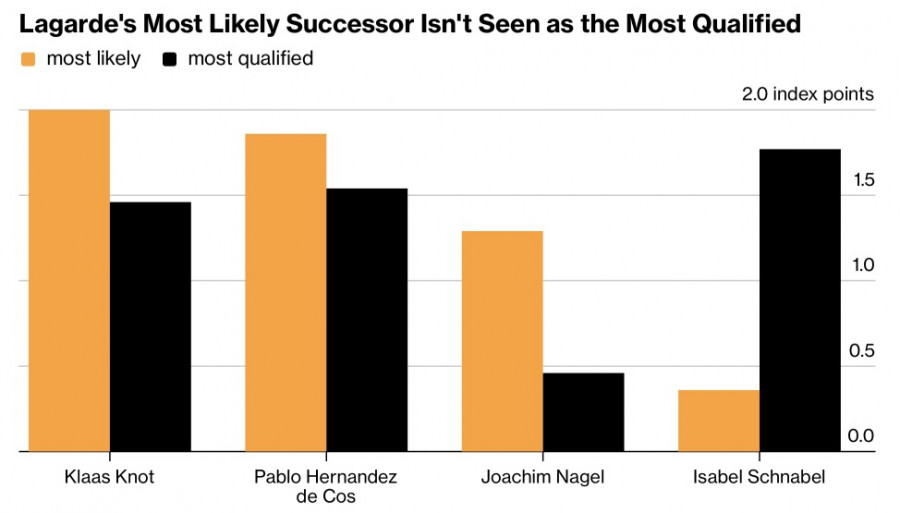

Despite Bloomberg experts considering Isabel Schnabel to have the highest qualifications, they estimate that Klaas Knot from the Netherlands has a good chance of becoming the head of the ECB. Both the Germans and the Dutch are ardent supporters of tightening monetary policy. If a hawk heads the Governing Council, the deposit rate could risk rising as early as 2026.

According to Capital Group, the ECB will begin a cycle of monetary tightening by the end of this year due to accelerating economic growth and inflation in the currency bloc. Consequently, EUR/USD might return above 1.20 and stay there for a long time. This view contradicts the expectations of the futures market, which gives low odds for a deposit rate cut. The base scenario is that borrowing costs will remain at 2% until the end of 2026.

Economic acceleration could be bolstered by the news of Sweden potentially joining the Eurozone. The armed conflict in Ukraine has significantly influenced this country's position. Initially, Stockholm joined NATO and is now considering replacing the krona with the euro. When residents rejected this idea in a referendum in 2003, they were guided by the principle that a weaker national currency would help exports.

However, over the past year, the krona has strengthened against the U.S. dollar by more than 16%, marking the second-best performance among the 30 most liquid currencies tracked by Bloomberg. As a result, Swedish sentiment toward joining the currency bloc is changing.

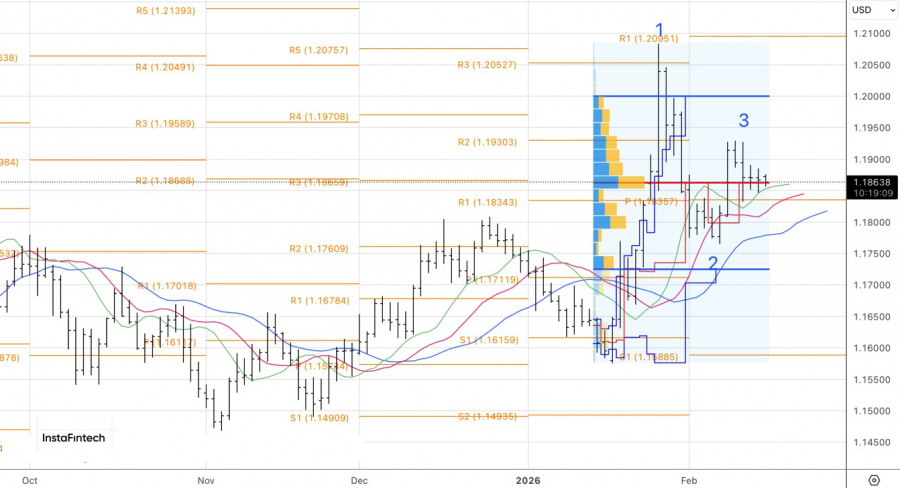

Technically, the daily chart of EUR/USD shows a short-term consolidation, with several doji bars forming. In such conditions, it makes sense to set a pending long position at 1.189 and a short position at 1.1845, and wait to see which triggers first. In the event of a stop-loss execution, this strategy can be used again.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.