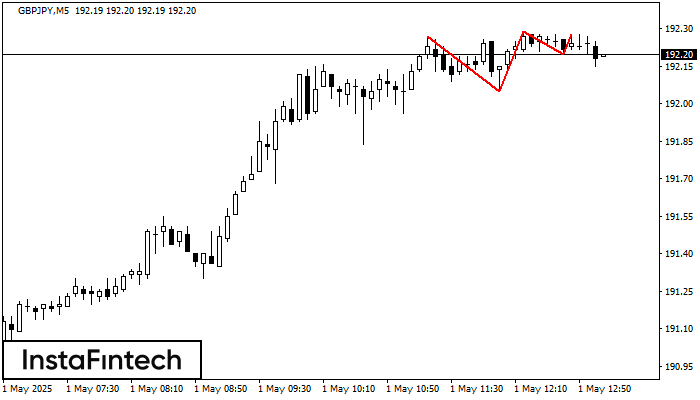

Triple Top

was formed on 01.05 at 12:05:13 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the GBPJPY M5 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -1, support level -15, and pattern’s width 22. Forecast If the price breaks through the support level 192.05, it is likely to move further down to 192.14.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength