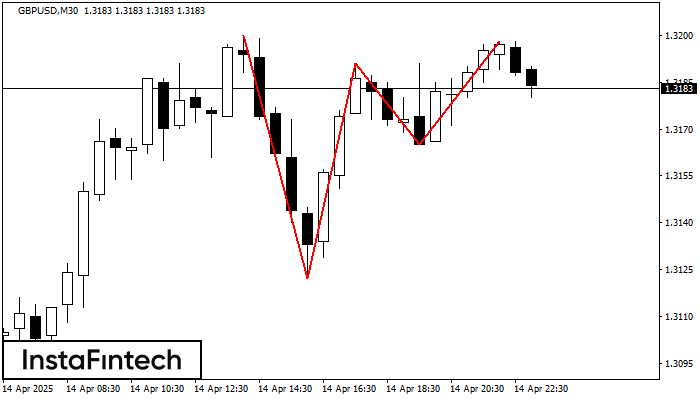

Triple Top

was formed on 14.04 at 22:30:39 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the GBPUSD M30 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level 2, support level -43, and pattern’s width 78. Forecast If the price breaks through the support level 1.3122, it is likely to move further down to 1.3161.

Figure

Instrument

Timeframe

Trend

Signal Strength