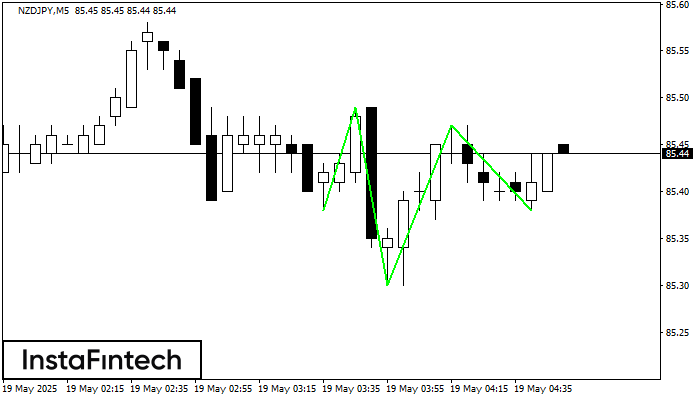

Inverse Head and Shoulder

was formed on 19.05 at 03:50:15 (UTC+0)

signal strength 1 of 5

According to M5, NZDJPY is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 85.49/85.47 is broken out, the instrument is likely to move toward 85.62.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength