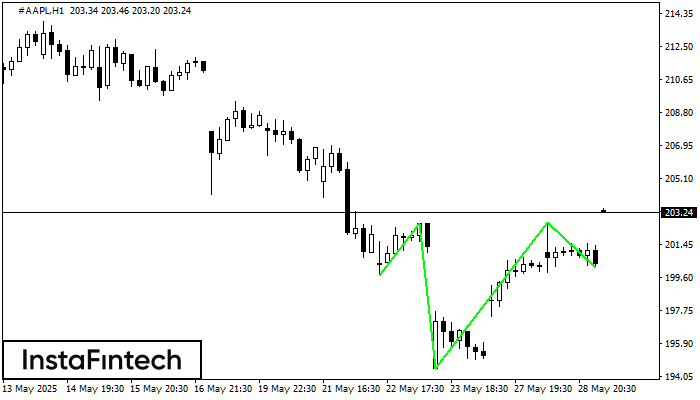

Inverse Head and Shoulder

was formed on 29.05 at 15:29:56 (UTC+0)

signal strength 4 of 5

According to the chart of H1, #AAPL produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 194.47 while the median line of the Neck is set at 202.62/202.68. The formation of the Inverse Head and Shoulder Pattern clearly indicates a reversal of the downward trend. In means that in case the scenario comes true, the price of #AAPL will go towards 203.08.

Figure

Instrument

Timeframe

Trend

Signal Strength