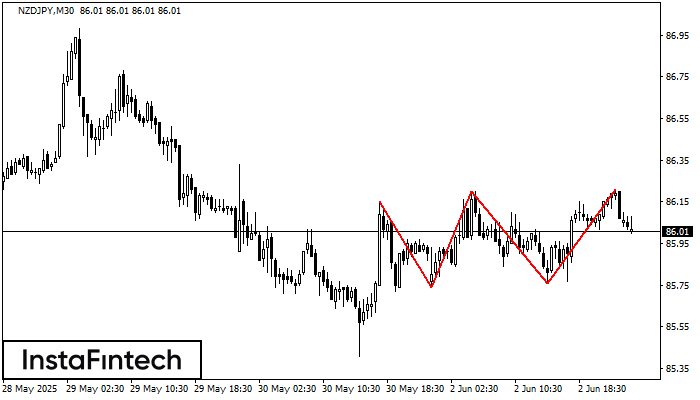

Triple Top

was formed on 03.06 at 00:30:20 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the NZDJPY M30. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 85.74/85.76 with the upper limit 86.15/86.21; the projection of the width is 41 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 85.74, the price is most likely to continue the downward movement.

Figure

Instrument

Timeframe

Trend

Signal Strength