Vea también

02.12.2024 02:30 PM

02.12.2024 02:30 PMThe US dollar, which recently pulled back to a nearly three-week low, is now confidently rebounding, supported by robust gains in US Treasury yields. This rebound has become the primary factor putting pressure on the precious metal.

Additionally, expectations that the tariff plans and expansionist policies of US President-elect Donald Trump will drive inflation higher are creating conditions for the Federal Reserve to pause its rate-cutting policy. This further undermines the potential growth of gold. However, concerns about a potential trade war and geopolitical tensions may help limit losses for the safe-haven asset.

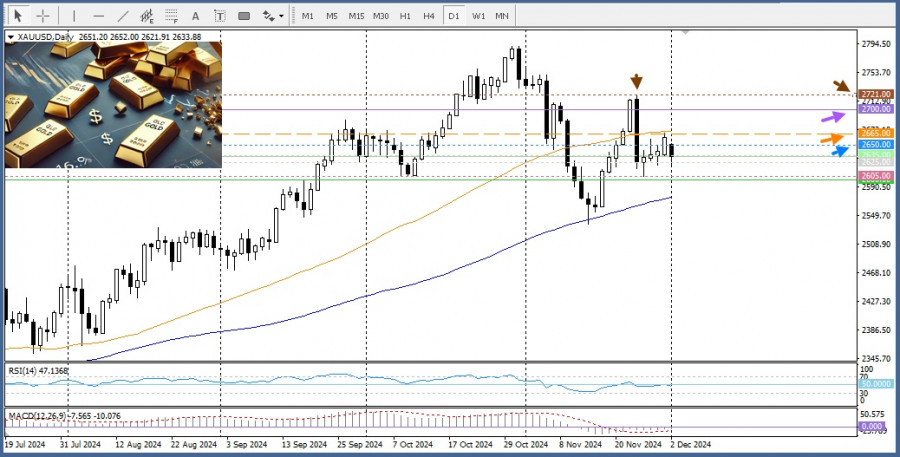

From a technical perspective, oscillators on both the daily and 4-hour charts are starting to show negative momentum, suggesting that the path of least resistance for gold prices lies to the downside.

As a result, a further decline toward last week's swing low, in the $2605 range, seems plausible.

A sustained break below the critical level of $2600 would expose the 100-day Simple Moving Average (SMA), currently positioned around $2575.

On the other hand, $2650 may act as an immediate barrier before the swing high from last Friday near $2665.A decisive move above this zone could allow gold to reclaim the $2700 psychological mark, paving the way for a further rise toward the supply zone at $2721–2722, which serves as a key turning point.

A strong breakout above this area would signal that the recent corrective decline from October's all-time high has concluded, allowing the upward trend to continue.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.