Vea también

03.04.2025 09:12 AM

03.04.2025 09:12 AMThe U.S. dollar had recently managed to stay above the key 104.00 mark on the ICE index, giving hope that a further decline might be avoided. But why did it tumble against other major currencies, especially considering that trade tariffs should also negatively impact the countries targeted by them?

Yes, this might seem odd at first glance, but there are clear reasons behind it, and they are likely to continue weighing on the dollar until the situation stabilizes.

As stated in a previous article, had Trump not introduced anything beyond the initially announced tariffs, the dollar might have received noticeable support yesterday. But that didn't happen. Instead, the U.S. president went beyond previously priced-in measures on the Forex market, equity indices, and Treasury yields. In addition to a base tariff of 10%—a more moderate figure than the previously floated 20%, which would have been seen as a positive—he announced additional tariffs for certain countries. According to Evercore ISI, the new weighted average tariff rate may rise to 29% after all new tariffs are implemented, the highest in over a century. This means that, collectively, the U.S. is imposing significantly higher trade barriers than initially expected.

Fears of a full-blown economic crisis and recession in the U.S. have driven investors into Treasuries, causing yields to plunge and adding downward pressure on the dollar. This decline in the Forex market is not due to strength in other currencies but rather the dollar's weakness. For example, the euro's rise contradicts the eurozone's economic issues. According to recent data, declining inflation raises the likelihood of further interest rate cuts—clearly a bearish factor for the euro versus the dollar, which might eventually find support on expectations of rate hikes if inflation picks up later this year.

In short, the dollar's drop is mostly an emotional reaction. This decline may be short-lived, ending once there's more clarity on the actual U.S. tariff rates and the retaliatory measures from trade partners. As mentioned above, fear of the unknown is pushing the dollar down. However, this decline could benefit the U.S., as it improves the competitiveness of American exports, which could strengthen the economy in the long run. In the meantime, speculators will likely take full advantage of the "tariff reality" before entering the market again at lower, more favorable price levels.

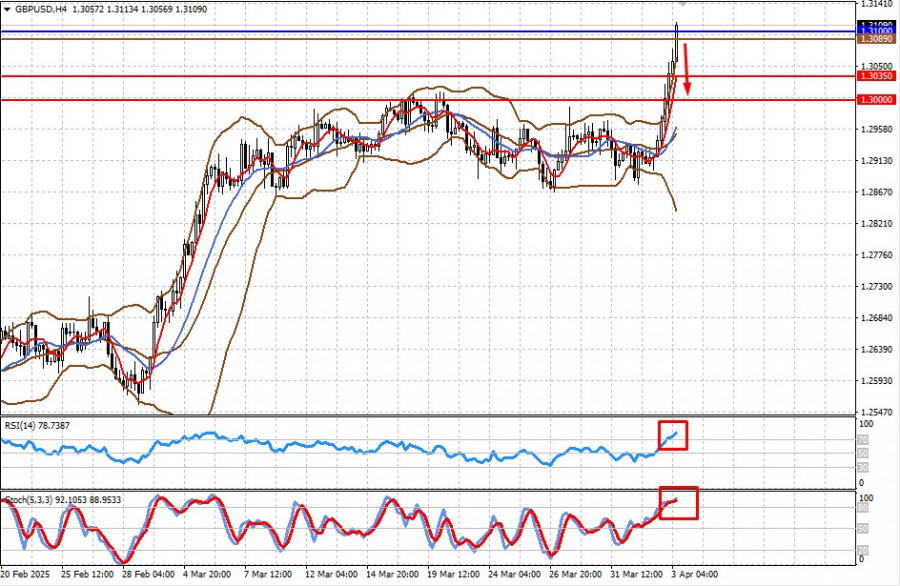

The pair is trading above the 1.3100 level. If it fails to hold above this mark, a pullback toward 1.3035 and then 1.3000 is likely.

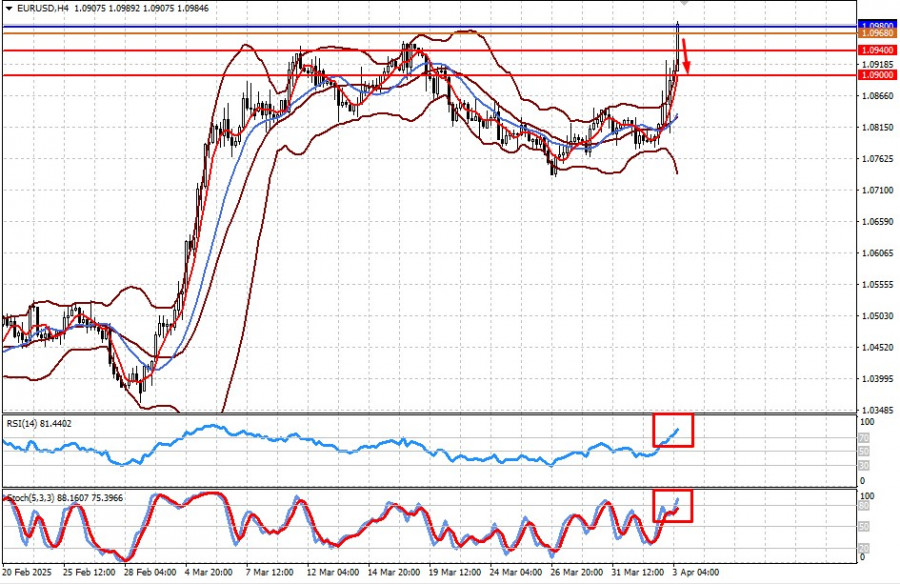

The pair is trading above the 1.0880 level. If it fails to stay above this level, a downward correction toward 1.0940 and then 1.0900 is possible.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.