Vea también

22.04.2025 01:07 AM

22.04.2025 01:07 AMBe careful what you wish for. Donald Trump's desire to make America great again and return to a golden age is backfiring by eroding trust in U.S. assets, capital flight, and a weakening dollar. The USD Index has fallen to its lowest levels since September, while the EUR/USD rally has accelerated amid the White House's criticism of Jerome Powell.

Can the U.S. President fire the Fed Chair he appointed? Formally, no, but the law does mention removal "for cause." In 2021, Powell and his colleagues viewed inflation as transitory, waited too long to raise rates, and, as a result, prices surged even further. The response to accelerating inflation was delayed, so Trump arguably has grounds to criticize the Fed chief. But this time, the story is different.

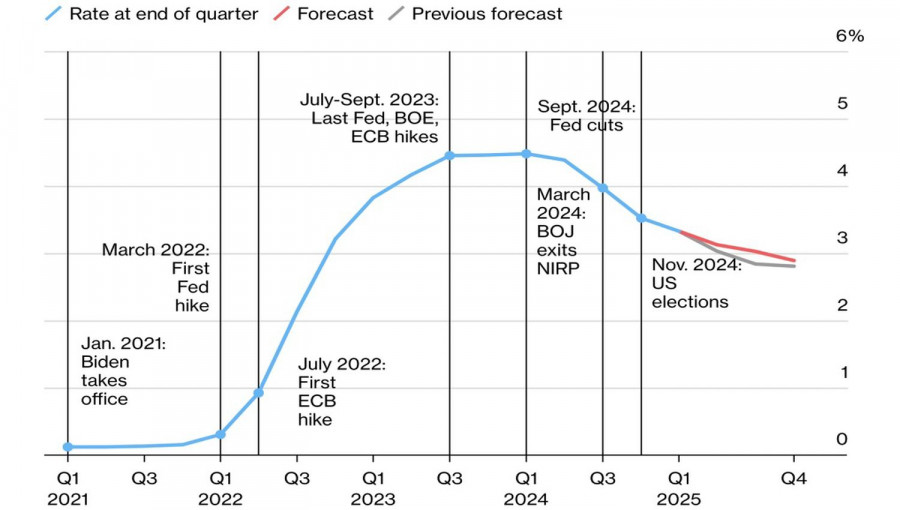

According to Bloomberg, central banks in developed nations are expected to lower borrowing costs by an average of 50 basis points by the end of 2025 to counteract the negative effects of trade wars. However, the theory says that the country imposing tariffs faces high inflation; the one facing those tariffs faces an economic slowdown. Other central banks have justification to ease monetary policy. The Fed does not. Powell is doing everything right, but the White House has other plans.

Monetary expansion could act as a lifeline for U.S. stock indices but would also further accelerate inflation, especially since tariffs are not the only factor fueling price growth. One of the key drivers of U.S. GDP growth in 2023–2024 was population increase, particularly due to immigration. If the economy loses 5.5 million semi-legal workers, it will lose momentum, while wages, on the contrary, will accelerate.

This outlines a stagflation scenario: the labor market is cooling, but prices are rising rapidly. This ties the Fed's hands, which operates under a dual mandate—controlling inflation and maintaining employment. The economy is suffering, and with it, the dollar. It's no surprise that speculators are dumping dollars, and Deutsche Bank now calls German and Japanese bonds a better safe-haven alternative to U.S. Treasuries.

According to French Finance Minister Eric Lombard, firing Powell would undermine trust in the U.S. dollar and destabilize the American economy. These processes are already well underway, but a loss of Fed independence would be the catalyst for a EUR/USD rally.

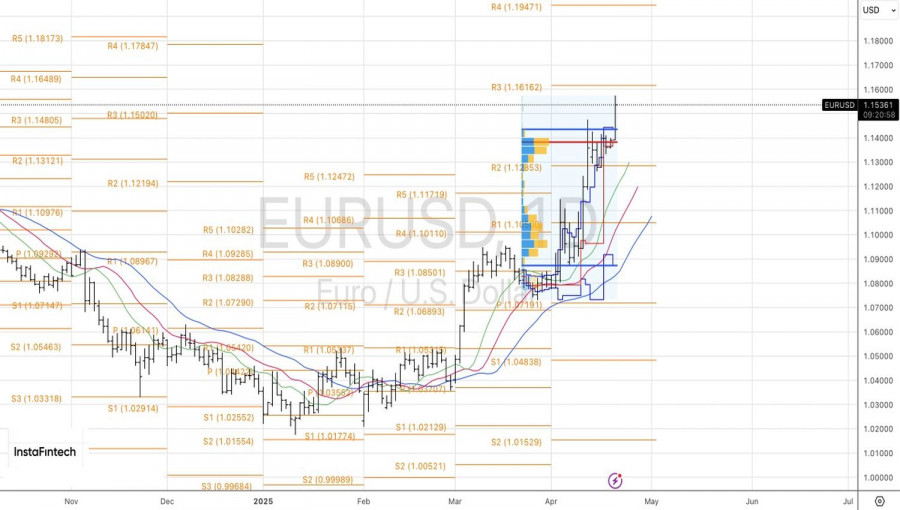

Technically, the daily chart of the main currency pair shows a recovery in the uptrend. Theoretically, the pair's return below 1.148 could trigger a reversal pattern like Anti-Turtles. But until that happens, bulls remain in control. It makes sense to hold and add to existing long positions in EUR/USD with targets at 1.16 and 1.12.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.