Vea también

25.04.2025 12:59 AM

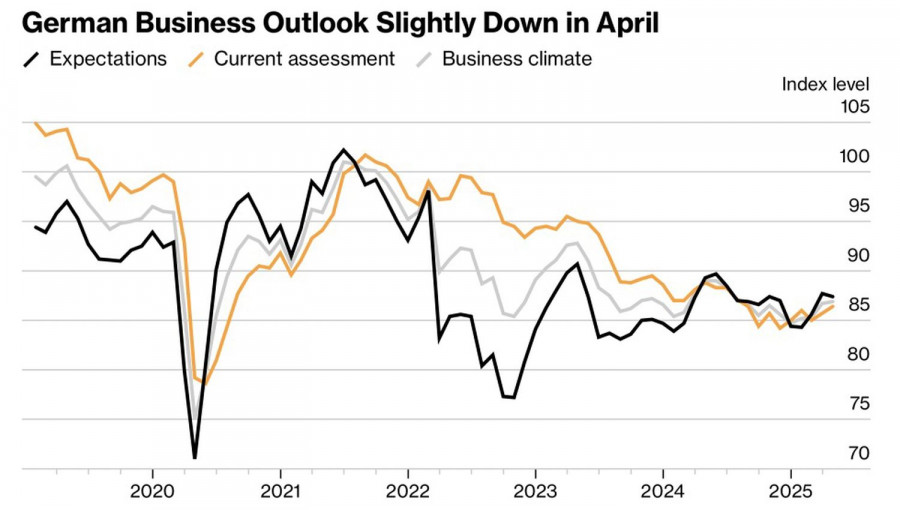

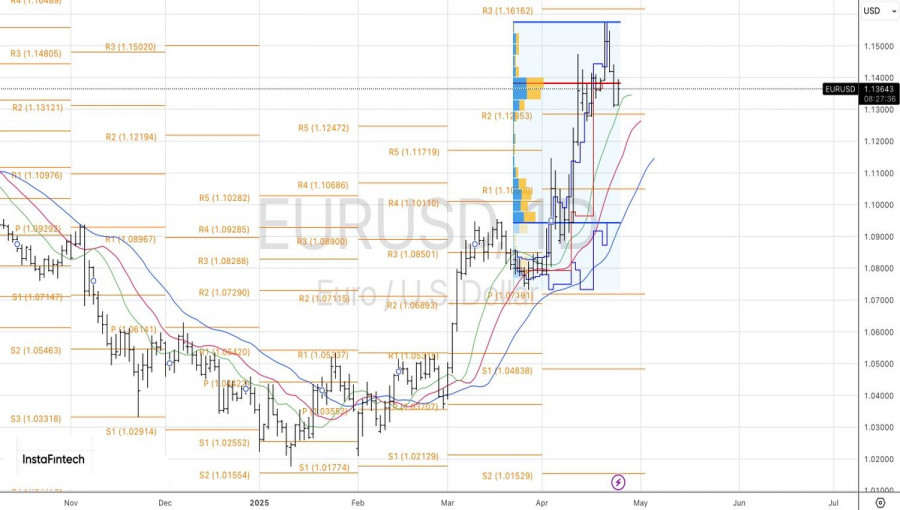

25.04.2025 12:59 AMWhen the market does not move as expected, it often goes in the opposite direction. In recent days, the euro has faced a barrage of negative news. Slowing business activity and weakened economic prospects for German companies were accompanied by warnings from the Bundesbank about a recession in Germany and remarks from European officials suggesting the regional currency is not a competitor to the US dollar. Nevertheless, EUR/USD has found support just above 1.13 and is attempting to regain control.

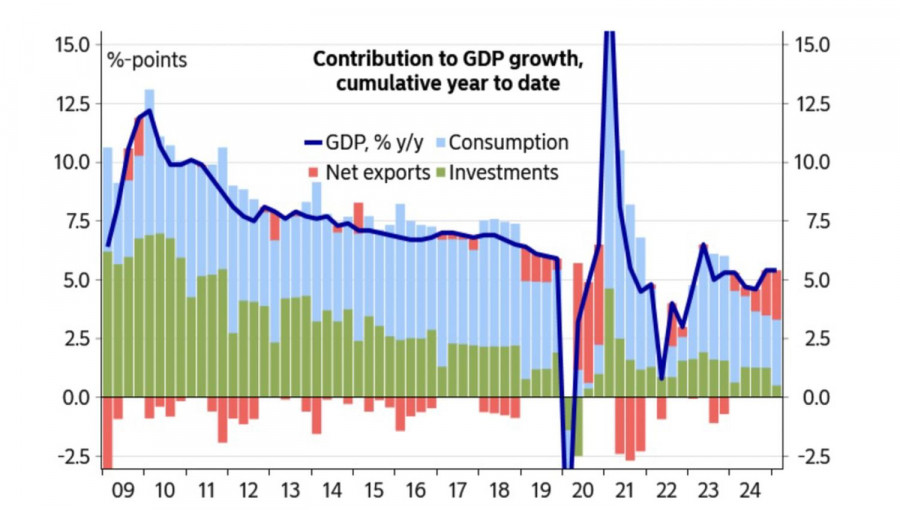

When Donald Trump returned to the White House, he came with the ambition to reshape the world. Tariffs were supposed to boost US budget revenues, while investments in the manufacturing sector would accelerate US GDP growth. However, as we approach 100 days since his inauguration, the 47th president's resolve seems to wane. The Republican did not anticipate the extent of the sell-off in US stocks and bonds, nor the flood of appeals from business leaders. They fear that import tariffs and interference with the Federal Reserve will lead to economic turmoil.

As a result, Trump is doing things he probably wouldn't have considered before—hinting at lower tariffs against China and claiming he has no intention of dismissing Fed Chair Jerome Powell. This has led to a correction in the heavily battered US dollar. And it is just a correction—no indication of a reversal in the upward trend of EUR/USD. For that to happen, the US president would need to abandon his trade war agenda.

I don't think that's likely. Treasury Secretary Scott Bessent talks about massive imbalances in foreign trade and insists they must be addressed. According to him, the US is helping China reshape its economy by shifting from an export-driven model to one centered on consumption—achieved through trade wars.

In reality, a reduction in the US trade deficit would simultaneously shrink the capital account surplus—meaning less capital would flow into the US to purchase stocks and bonds. With Washington's national debt at $29 trillion and the Congressional Budget Office forecasting a $1.9 trillion budget deficit, the holes will be challenging to fill—especially if Trump proceeds with extending the tax holiday and political battles over the debt ceiling continue.

Despite the euro's current weakness, a lack of investor confidence in the US dollar suggests that the major currency pair will soon restore its upward trend. It is only a matter of time.

Technical outlook: The bulls are attempting to regain momentum on the daily EUR/USD chart. If an inside bar pattern forms, buying opportunities will emerge on a breakout above resistance at 1.139. A rebound from support at 1.127 or 1.118 also serves as a signal to open long positions.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.