Vea también

02.05.2025 01:02 AM

02.05.2025 01:02 AMThe market has finally found relief after America's Liberation Day. Stock indices are ready to recover the ground lost following the White House's implementation of sweeping tariffs amid expectations of strong earnings from the "Magnificent Seven" companies. Against this backdrop, EUR/USD bears attempted a counterattack. However, the erosion of trust and the decline of American exceptionalism weigh heavily on the U.S. dollar.

After the turmoil of April, the market has started to accept that Donald Trump likely doesn't want higher tariffs. He introduced them as a tactic to force other countries to the negotiating table and to compel them to lower tariffs previously imposed on U.S. goods. Theoretically, this would pave the way for freer international trade and a brighter future for the United States.

Unfortunately, tariffs in most countries are already lower than in the U.S. What can they really offer Washington? Increased purchases of American goods? As the first trade war showed, China made such promises but didn't deliver. Nevertheless, for the markets, even a phony deal can be enough to spark optimism.

As long as the current 90-day truce remains in effect, the negative impact on competing economies — including the eurozone — is unlikely to be felt. In Q1, the euro area's GDP grew by 0.4% quarter-over-quarter and 1.4% year-over-year, driven by export growth. A repeat in Q2 is entirely possible. Unsurprisingly, non-U.S. equities continue to outperform the S&P 500, including in terms of recovery speed after downturns. If this trend continues, the capital flow from North America to Europe will continue to support the EUR/USD rally.

According to Danske Bank, the euro should be bought on pullbacks against the U.S. dollar for several reasons. The U.S. is facing a crisis of trust. Restoring it would require a series of favorable political signals — which seems unlikely. Ongoing uncertainty in White House policy keeps demand high for safe-haven assets, and the euro currently plays that role more effectively than the dollar. Finally, U.S. data is being ignored, and markets are listening only to White House officials — a trend that can't last forever.

Regardless of what Donald Trump says, U.S. recession risks are growing rapidly. Former Federal Reserve Chair Janet Yellen is convinced of it, and current FOMC members are also likely becoming concerned. The May Fed meeting may be the perfect opportunity to signal future rate cuts, which would drag the dollar down even further.

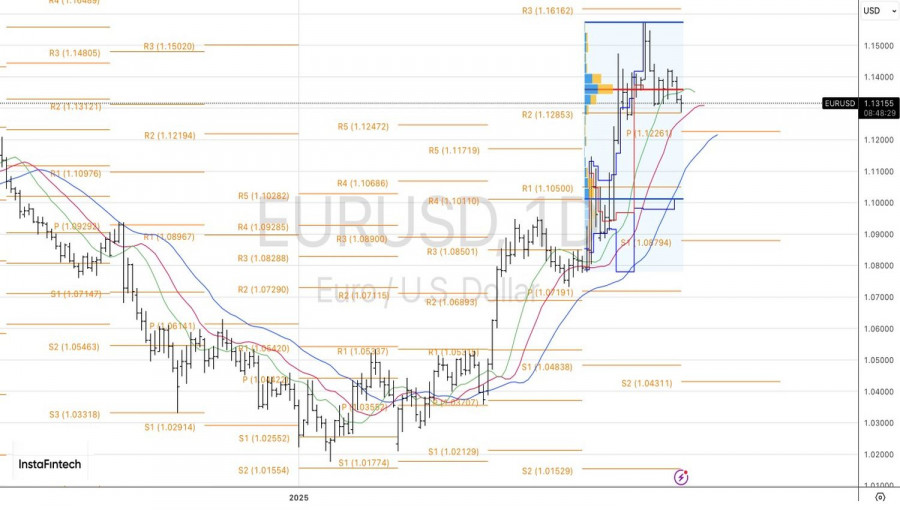

Technically, on the daily EUR/USD chart, a breakout below the 1.130–1.140 consolidation range was attempted. The failure of this breakout confirms the bears' weakness and increases the likelihood of the "Spike and Ledge" pattern morphing into a "False Breakout." A euro return to $1.136 would serve as a buy signal.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.