Vea también

22.05.2025 12:05 AM

22.05.2025 12:05 AMA collapse in confidence in the U.S. dollar, rumors of coordinated currency intervention, and capital repatriation to Japan are driving USD/JPY back into a downtrend. The music playing in the bulls' camp, based on speculation that the Bank of Japan would not raise the overnight rate in 2025, didn't last long. The pullback turned into an excellent opportunity to enter short positions.

As the G7 summit of finance ministers and central bank governors in Canada nears, speculation about a coordinated intervention in the foreign exchange market to weaken the U.S. dollar is intensifying. Parallels are being drawn with 1985, when the Plaza Accord saw the U.S. compel its allies to strengthen their currencies, causing a sharp drop in the USD index: Donald Trump, notably, dreams of a weaker dollar to boost the competitiveness of American companies.

However, the growing risk of large-scale intervention isn't the only reason USD/JPY is declining. Japan is experiencing a so-called "buyer strike," which is driving up local bond yields at the fastest pace among developed nations, increasing debt servicing costs, and becoming a headache for the government.

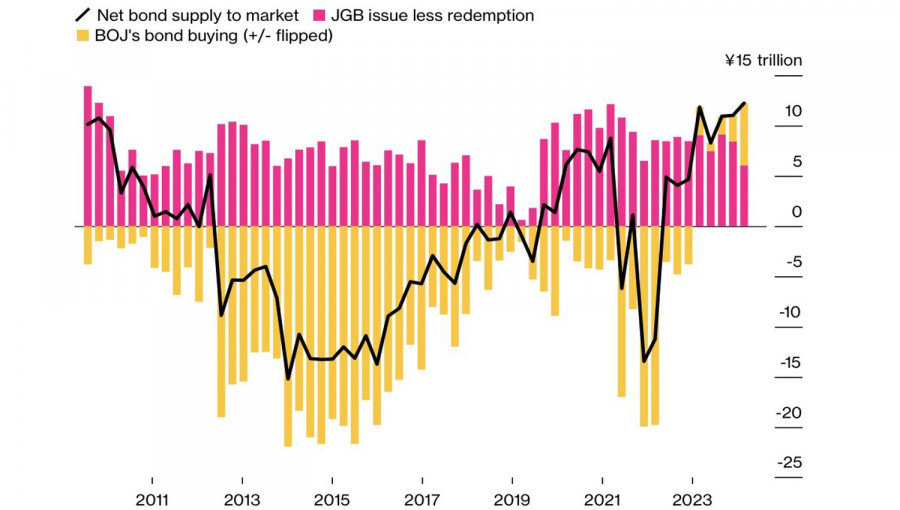

The BoJ has redeemed more bonds from its balance sheet than it has purchased anew. Tokyo needs to fill the gap with new issuances, but the Ministry of Finance is struggling to find buyers in the primary market, as investors prefer the secondary market amid rising yields.

According to BoJ and Bloomberg data, net bond issuance has reached the highest levels since 2010, with supply outpacing demand. This has led to falling prices and rising yields. The yield spread between Japanese and U.S. bonds is narrowing, prompting capital repatriation to Japan and further pushing USD/JPY down.

The yen's strengthening is happening amid rising global risk appetite, which is somewhat puzzling. Typically, safe-haven assets come under pressure in such conditions. However, the bears in USD/JPY have plenty of arguments to push the pair south.

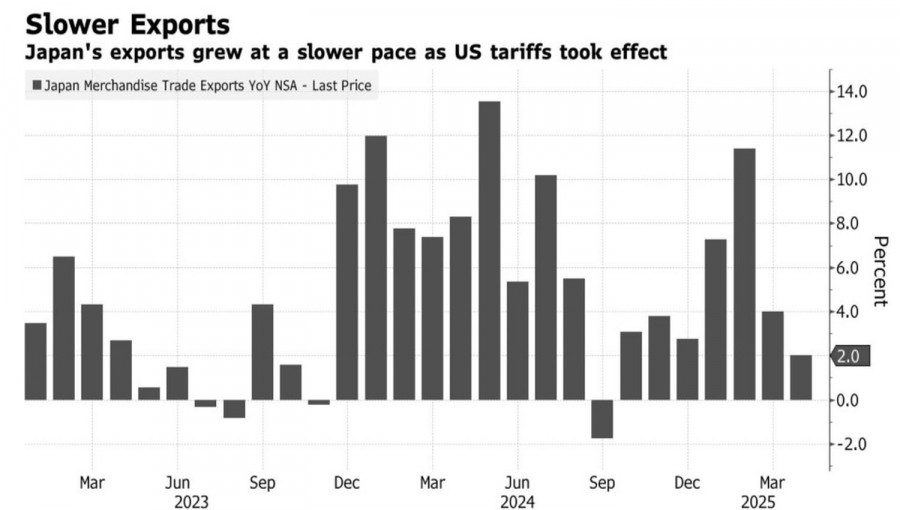

They aren't even deterred by the significant slowdown in April's exports, from +4% to +2%, which has been linked to sweeping tariffs imposed by the White House. In reality, exports to the U.S. declined by just 1.8%, while European exports dropped by 5.2%. Regardless, the disruption in trade relations will ultimately reduce foreign trade volumes, negatively impacting the economy and likely preventing the BoJ from resuming monetary policy normalization.

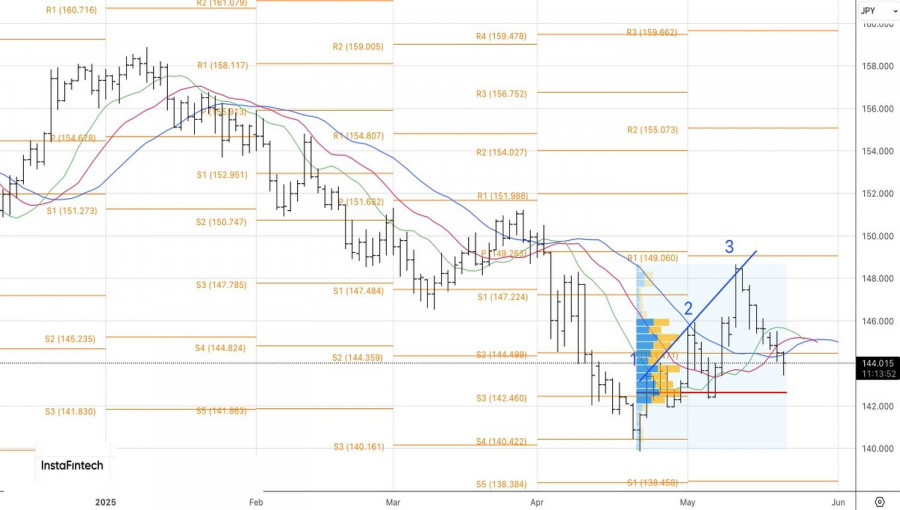

Technically, on the daily chart, USD/JPY has fulfilled the previously identified reversal pattern "Three Indians." The first target from shorts initiated at 147.1, down to 144.5, was successfully hit. Now, two more targets at 142.5 and 140.0 remain. It makes sense to hold short positions and consider adding to them periodically.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.