Vea también

22.05.2025 06:16 PM

22.05.2025 06:16 PMThe approval by the House of Representatives of what Donald Trump called a "big and beautiful" tax-cut bill, along with a rise in the U.S. composite PMI from 50.6 to 52.1, helped the U.S. dollar regain its footing. EUR/USD fell below the 1.13 level. However, if the U.S.-born financial "contagion" spreads to the broader global financial system, the euro could ultimately benefit.

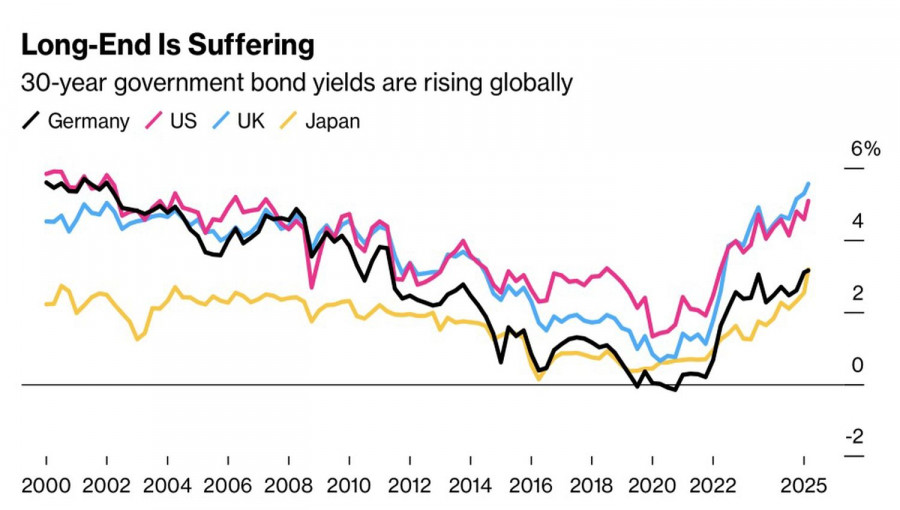

The downgrade of the U.S. credit rating and a poorly received 20-year Treasury auction accelerated the rise in Treasury yields. Yields on 30-year bonds are hovering near their highest levels since 2007. Similar trends are being observed in other countries as well. For example, Japan's 30-year government bond yield recently hit a new record high since data collection began in 1999.

Bond Yield Trends

Investors increasingly believe that governments can no longer afford to accumulate debt at the pace seen when interest rates were near zero. Meanwhile, central banks—led by the Federal Reserve—are in no hurry to cut rates amid trade wars, high tariffs, and rising inflation risks. A global financial crisis, where governments' growing fiscal appetites are left unfunded, would push investors to seek safe havens. And that status has been lost by the U.S. dollar.

In the recent past, the logic was simple: when the global economy weakened, traders bought the U.S. dollar; when it improved, they favored the euro. But Donald Trump's return to the White House has turned everything upside down. Distrust in the policies of the 47th U.S. president has made American assets appear unsafe. Today, gold, the Japanese yen, the Swiss franc, and German government bonds look more attractive as safe-haven alternatives.

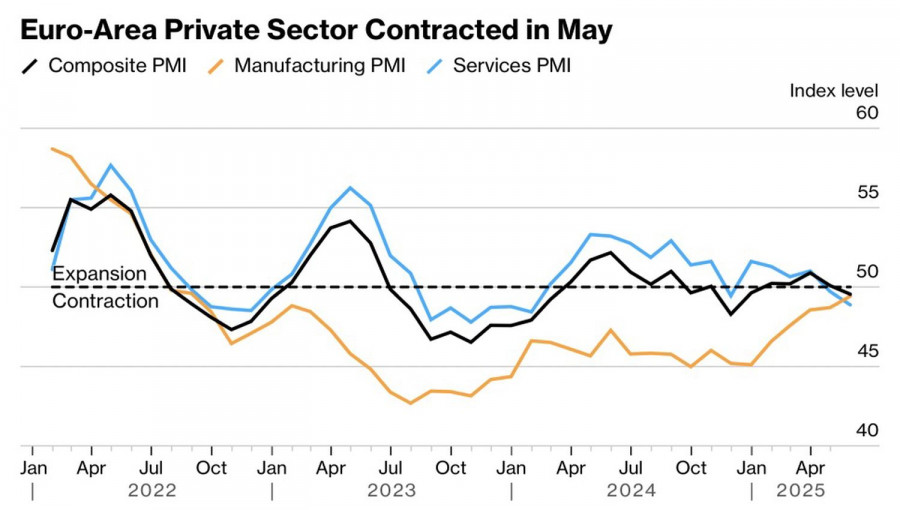

For now, investors are focusing on divergence in economic growth. The eurozone composite PMI fell below the critical 50 level in May, signaling GDP contraction in the currency bloc. In contrast, U.S. business activity rose to a two-month high.

European Business Activity Dynamics

Thus, while EUR/USD bears are supported by stronger U.S. business activity compared to Europe and the Fed's reluctance to restart a monetary easing cycle—at least until September—bulls have their own arguments. These include mistrust of the U.S. dollar, concerns about the stability of the American fiscal system, and capital flows shifting from North America to Europe.

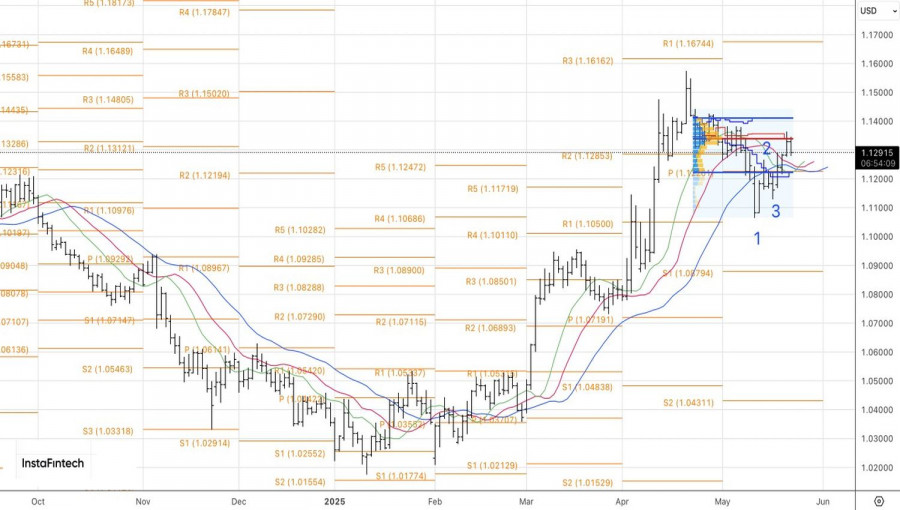

Technical Outlook

On the daily chart, EUR/USD rebounded from its fair value at 1.1335. Key support lies near the lower boundary of the 1.122–1.141 range, where several moving averages are clustered. A rebound from this level could support a buildup of long positions, while a breakdown would signal a potential trend reversal and justify short-term selling.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.