Vea también

17.06.2025 12:39 AM

17.06.2025 12:39 AMWhen there's money, you buy the best. In past years, the US dollar and dollar-denominated assets—especially shares of the "Magnificent Seven"—were considered the best investments. American stock indices and the US economy were far ahead of the rest. During periods of turmoil, traders would eagerly buy the US dollar as if it were in high demand. But in 2025, everything has turned upside down. The uptrend in EUR/USD is gaining momentum. Credit Agricole cites three reasons why it is likely to continue.

First, there are rising dovish expectations regarding the Federal Reserve's monetary policy. A slowing US economy and inflation's unwillingness to rise are pushing the central bank toward resuming its rate-cutting cycle.

Second, there is diminished confidence in the U.S. dollar as the primary reserve currency. The greenback still accounts for 46% of global forex reserves, gold for 20%, and the euro for just 16%. However, the European Central Bank seriously aims to promote the euro as a means of international settlement and reserve currency.

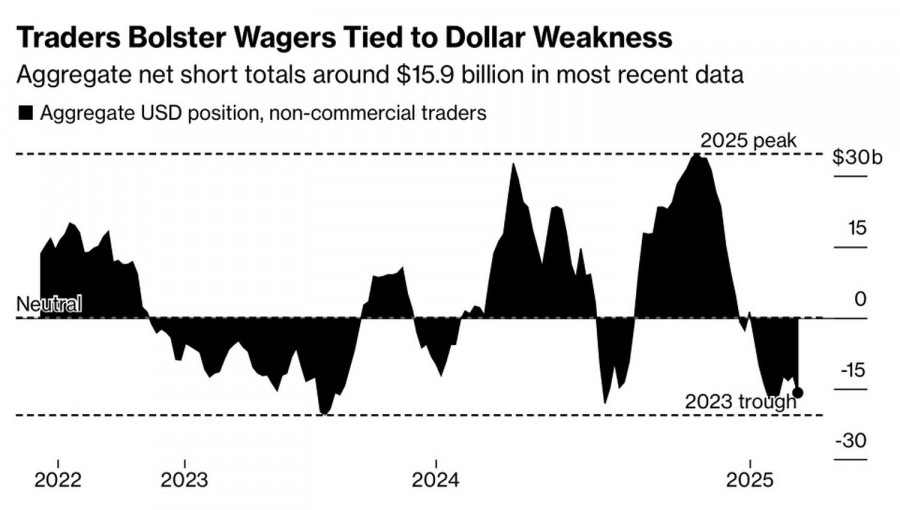

Third, trade risks are rising as grace periods expire. Donald Trump has stated he will send letters to countries outlining the tariff rates imposed against them. The White House intends to raise auto import tariffs from 25% to 50%. Given the USD index sell-off on U.S. Independence Day, it can be assumed that any escalation of trade wars will benefit EUR/USD. Unsurprisingly, speculators continue to increase short positions against the U.S. dollar.

It's difficult to gauge how the Israel-Iran standoff will affect the main currency pair. On one hand, rising geopolitical risks in the Middle East are negative for the U.S. dollar, which has lost its safe-haven status. The dollar is under pressure due to declining U.S. stock indices and the associated deterioration in global risk appetite.

On the other hand, rising oil prices are giving EUR/USD bears some leverage. The U.S. is a net oil exporter, while the eurozone is a net importer. Moreover, according to a Bloomberg study, a Brent rally to $100 per barrel would increase gasoline prices by 17% and push U.S. inflation to 3.2% by the end of June. Under such conditions, the Fed may choose not to cut rates in 2025.

How the Fed responds to the armed conflict in the Middle East will be critical. Any upward revision of inflation forecasts or a scaling back of expected monetary easing for this year would be interpreted by investors as a signal to sell EUR/USD. The euro will likely break through its local highs if those fears don't materialize.

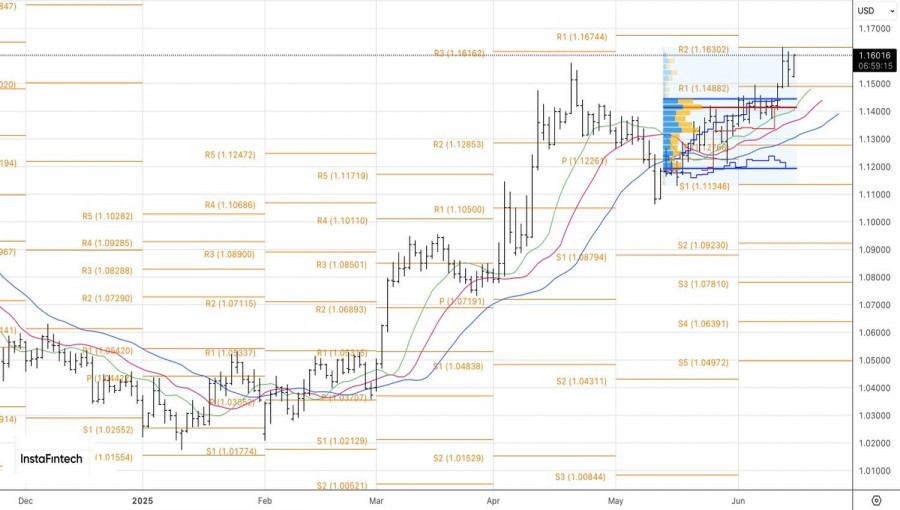

Technical outlook on the daily EUR/USD chart shows that bulls intend to play out an inside bar pattern. A breakout above the upper boundary near 1.1615 would allow for an increase in long positions initiated at the 1.149 support rebound.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.