Vea también

16.01.2026 12:35 PM

16.01.2026 12:35 PMAt the time of publication on Friday, the EUR/USD pair is fluctuating slightly above the round 1.1600 level, showing minimal change on the daily timeframe and ending a three-week losing streak. The pair fell by 0.34% the previous day amid strong U.S. employment and manufacturing reports, which reinforced the view that the Federal Reserve will keep interest rates unchanged in the coming months.

Economic releases from the U.S. Department of Labor published on Thursday recorded a decline in initial jobless claims, contrary to consensus forecasts, easing concerns about a weakening labor market.

In addition, the New York State manufacturing activity index and the Philadelphia Fed manufacturing survey showed results that significantly exceeded expectations, highlighting a strong start to the year for the sector.

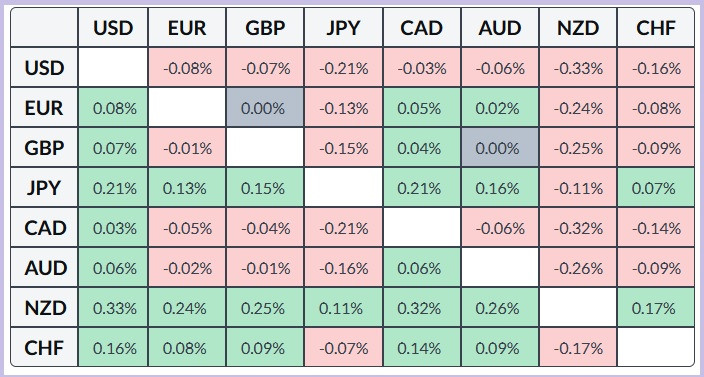

Data released today, Friday, from the eurozone confirmed that Germany's year-on-year consumer inflation in December fell to the European Central Bank's target level of 2%. In the U.S., the focus will shift to December industrial production and speeches by Fed Vice Chairs Michelle Bowman and Philip Jefferson. The table below shows the daily percentage change of the euro against the major currencies. The most notable gain in the euro was seen against the U.S. dollar.

From a technical perspective, the pair held above the round level amid positions closing ahead of the weekend. The nearest resistance is at 1.1620, above which the pair will aim for the confluence of the 50-day SMA and the 9-day EMA. Price found support at the round 1.1600 level, below which lies the very important 200-day SMA. Failure to hold above it would accelerate the decline toward the round 1.1500 level. Oscillators on the daily chart are negative, so bears remain in control of the situation.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.