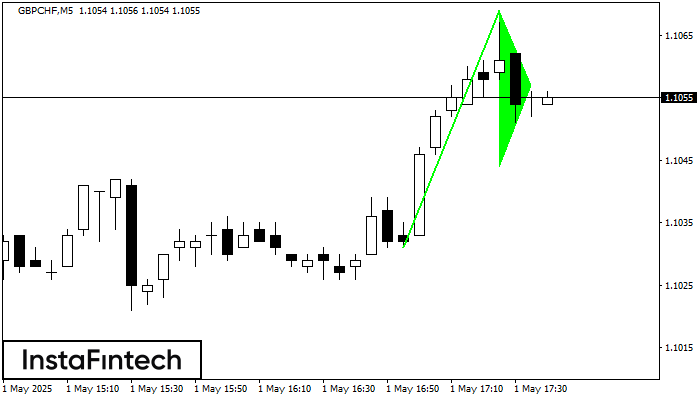

Bullish pennant

was formed on 01.05 at 16:40:46 (UTC+0)

signal strength 1 of 5

The Bullish pennant signal – Trading instrument GBPCHF M5, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 1.1069, with the prospect of the next move being a projection of the flagpole height.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength