See also

15.04.2025 09:08 AM

15.04.2025 09:08 AMWhile there is still no peace in the trade conflict, a semblance of a ceasefire has appeared. The White House is beginning to frantically realize it has gone too far with its protectionist policies and is slowly but surely making concessions. First, it announces removing tariffs on electronics; then, it starts talking about easing restrictions on the automotive industry. This has allowed the S&P 500 to rise for the second consecutive day.

Investors are increasingly convinced that aggressive tariff policy has limits. Perhaps this is driven by Donald Trump's desire to see rising stock indices or by the Treasury's aim to bring down bond yields. When the S&P 500 was falling, and bond yields were rising on fears of mass selloffs by China, the White House took a step back in advancing import tariffs.

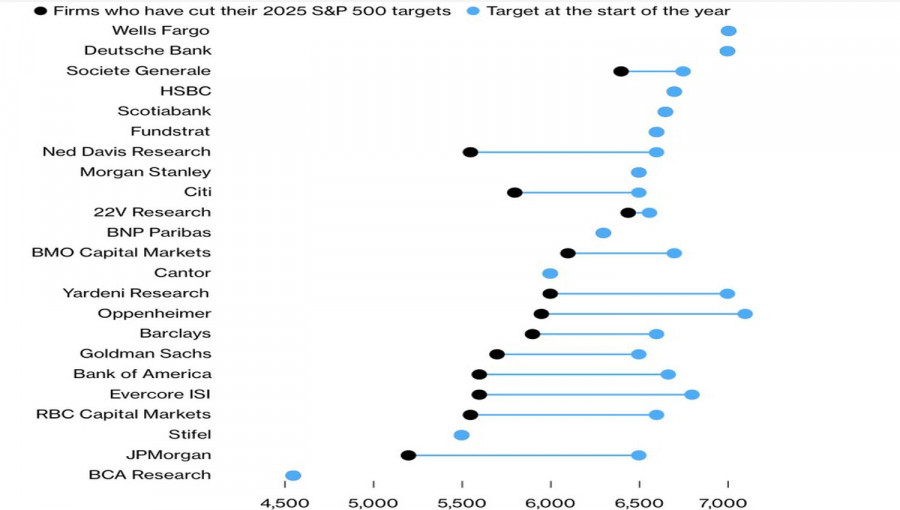

Despite elevated uncertainty, most banks and investment firms are optimistic about the broader stock index's prospects. They expect a recovery by year-end, with the median forecast at 6,067—roughly 12% above current levels.

At the same time, the chaotic nature of Donald Trump's policies has led to the broadest range of forecasts for the S&P 500 in at least two decades. Optimists view the White House's actions as savvy diplomacy, believing that after trade deals are reached with other countries, the tariffs will be lifted. Pessimists remain convinced that a recession and declining corporate profits are inevitable.

Interestingly, the current forecasts from banks and investment firms go against historical patterns. Since 1957, the S&P 500 has declined by 15% or more before April, only 16 times. In just three of those cases — in 1982, 2009, and 2020 — the index rebounded and ended the year in the green. In each instance, the Federal Reserve saved the market. If history teaches us anything, it is to expect either aggressive monetary expansion or that the majority view may be incorrect.

U.S. administration officials are also contributing to the broad index's recovery. According to National Economic Council Director Kevin Hassett, there's "no talk" of a U.S. recession, and Donald Trump is ready to listen to and hear the concerns of American business leaders. Treasury Secretary Scott Bessent has stated that the Treasury has the tools to stabilize the bond market.

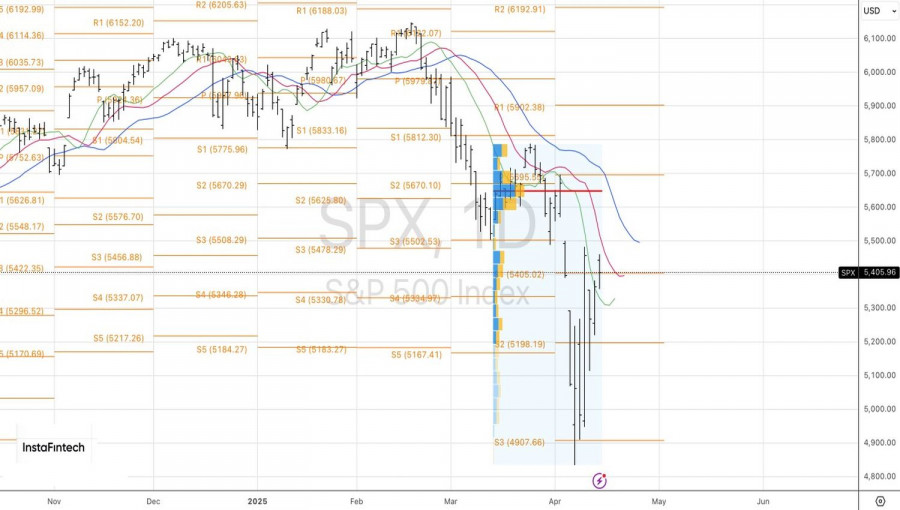

Technically, the daily S&P 500 chart shows a completed inside bar, which provides an entry point for long positions from 5,355. However, the likelihood of consolidation remains high, so a rejection from resistance levels at 5,500 or 5,600 would be a good opportunity for short positions — as would the index's inability to hold above the pivot level at 5,400.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.