See also

06.05.2025 07:08 PM

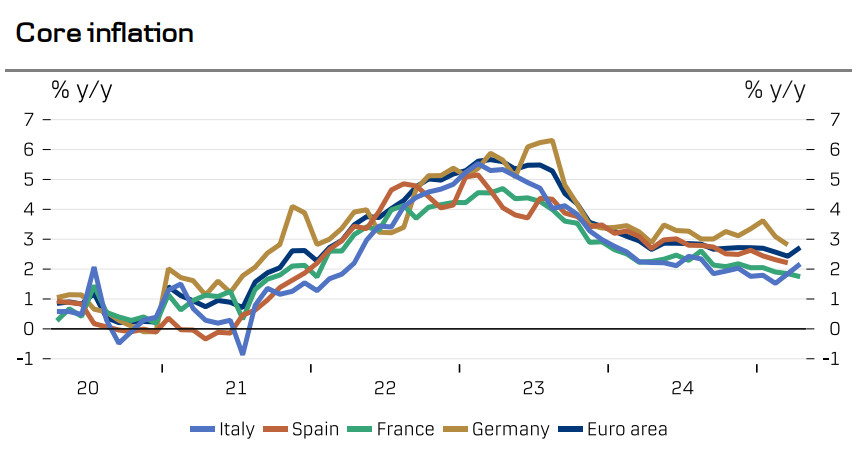

06.05.2025 07:08 PMInflation in the eurozone remained at 2.2% year-on-year in April, slightly above the expected decline to 2.1%. Meanwhile, core inflation rose from 2.4% to 2.7%, significantly exceeding the forecast of 2.5%. The monthly increase was the highest in a year, revealing that price pressures—primarily in the services sector—remain elevated.

The economic situation has become more ambiguous. The manufacturing sector saw PMI rise from 48.6 to 49.0, whereas a slight decline had been expected. Still, this improvement was not enough to push the index into expansion territory. At the same time, the services PMI fell into contraction for the first time since November, dropping from 51.0 to 49.7. On one hand, this may reflect reduced consumer spending due to weak confidence, but it may also signal growing concerns over a potential trade war.

So far, the threat of a trade war has not been reflected in Q1 data—GDP rose by 0.4%, roughly in line with expectations. However, the risks are substantial, and future growth is likely to be weak.

Faced with weak external demand and the threat of a tariff war, the European Central Bank adopted a dovish stance at its April meeting, lowering the key interest rate from 2.50% to 2.25%. However, the sharp increase in core inflation introduces uncertainty.

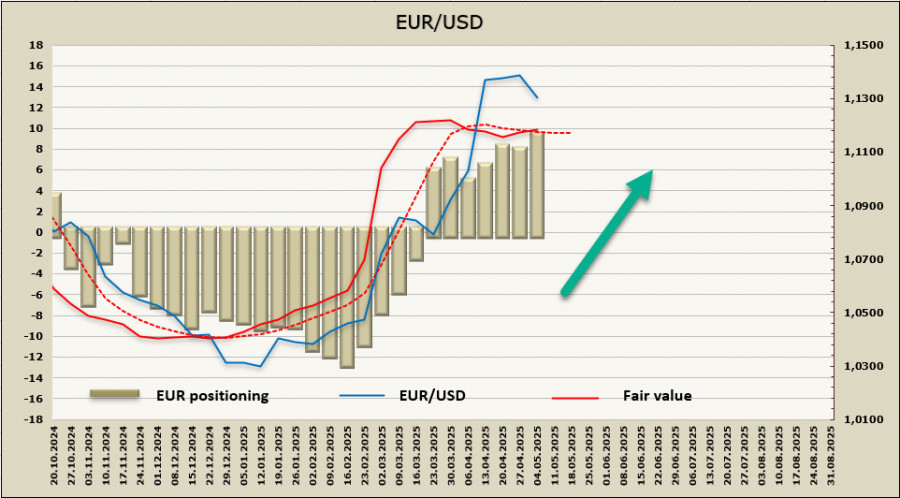

Before the inflation report was released, markets had expected rate cuts at the next three ECB meetings. The euro responded confidently to expectations of lower yields, holding near its highs against the dollar. But the outlook has now shifted: the threat of persistently high inflation may force markets to reassess their rate forecasts, which could trigger renewed euro appreciation.

The key event will likely be the Q1 GDP report. Until then, only the Fed and market reaction to its meeting outcome could trigger strong moves. If that doesn't happen, the euro is expected to continue consolidating while awaiting domestic data.

Positioning and Technical Outlook

EUR/USD is currently consolidating after forming a more than three-year high, but the correction depth has remained shallow, with the pair holding above the previous high of 1.1233. Technically, this signals a potential for continued growth.

Much may change following the FOMC meeting on Wednesday, but if the outcome broadly aligns with market expectations, the euro could have a good chance to resume its rally—first toward 1.1574, and if it successfully breaks above, the long-term target could shift to 1.2350.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.