See also

08.05.2025 12:47 AM

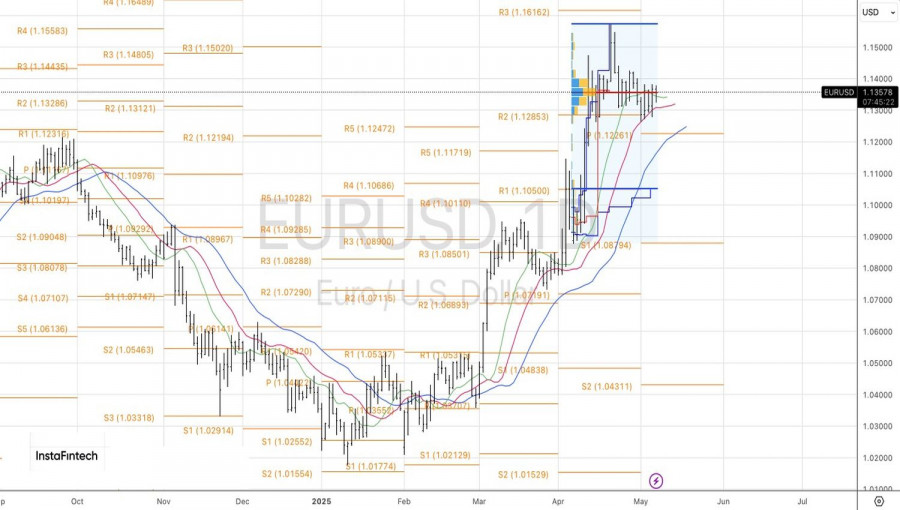

08.05.2025 12:47 AMCan the Fed Take the Spotlight? Or will the White House's tariff policy continue to overshadow the central bank's actions? The upcoming FOMC meeting and the start of U.S.–China negotiations will shed light on these questions. Recently, markets have been reacting almost exclusively to trade war headlines, which have been mixed and caused EUR/USD to fluctuate within a consolidation range of 1.128–1.138. Only a confident breakout from this range will allow the pair to define its next direction.

In recent days, both the U.S. and China have sent signals of rapprochement, which financial markets interpreted as a de-escalation of tensions. Ultimately, Beijing introduced fiscal stimulus for its economy and headed to Switzerland, where White House representatives await.

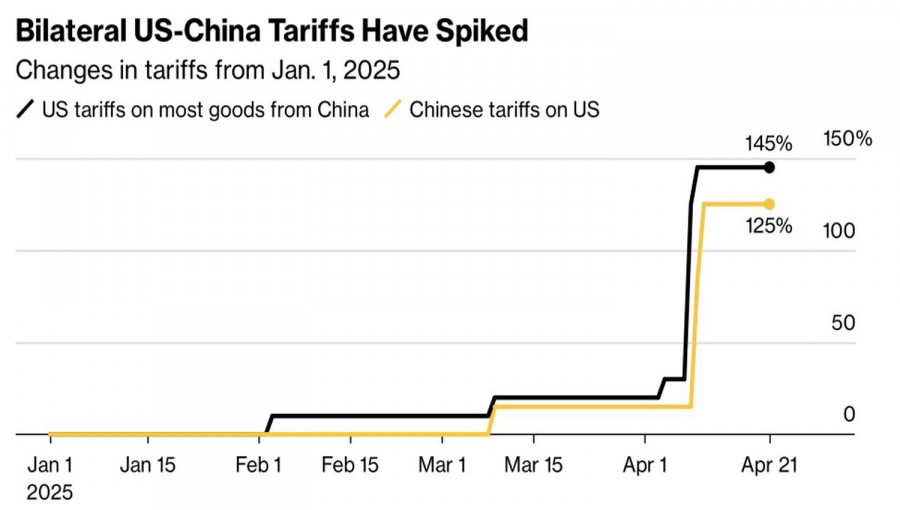

Undoubtedly, such draconian tariffs as 145% and 125% cannot last long. HSBC forecasts that tariffs on U.S. imports will eventually be reduced to 50%, while Morgan Stanley expects Washington to take a more gradual approach. The base scenario is a 90-day grace period for China to prepare its counterproposals, similar to the strategy used with other countries.

Investors are optimistic that the worst is behind us. The peak of the trade conflict has been reached, and its de-escalation, along with the Fed's decision, may boost U.S. stock indexes and the dollar.

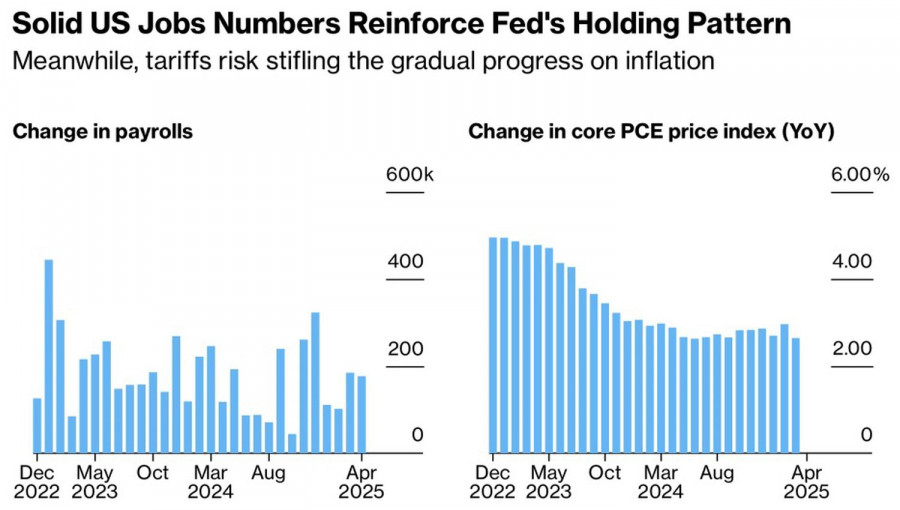

The central bank is expected to keep the federal funds rate at 4.5%, supported by a strong labor market and slowing inflation. Despite Donald Trump's repeated calls to lower the rate, the Fed fully understands that resuming monetary easing too early risks reigniting consumer price growth, especially amid high tariffs.

The Fed resembles a goalkeeper during a penalty shootout, shifting between recession and stagflation. It will most likely act preemptively—if labor market weakness begins to show, a rate cut may follow. Still, such a move is more likely in the autumn, allowing EUR/USD bears to hold their ground.

If positive news emerges from the U.S.–China negotiation table, the EUR/USD pair could enter a corrective phase. However, the euro still has several strong arguments to resist such a bearish outcome. Friedrich Merz successfully became Germany's chancellor, albeit on a second attempt, and European assets appeared more attractive than their American counterparts.

Technically, EUR/USD remains in consolidation on the daily chart. A breakout above the upper boundary of the trading range (1.1280–1.1380) does not guarantee a smooth ride for bulls or a return of the uptrend. A false breakout above 1.1380 or 1.1425 could trigger patterns like Bull Trap and Expanding Wedge, potentially setting the stage for new selling pressure.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.