See also

26.06.2025 12:42 AM

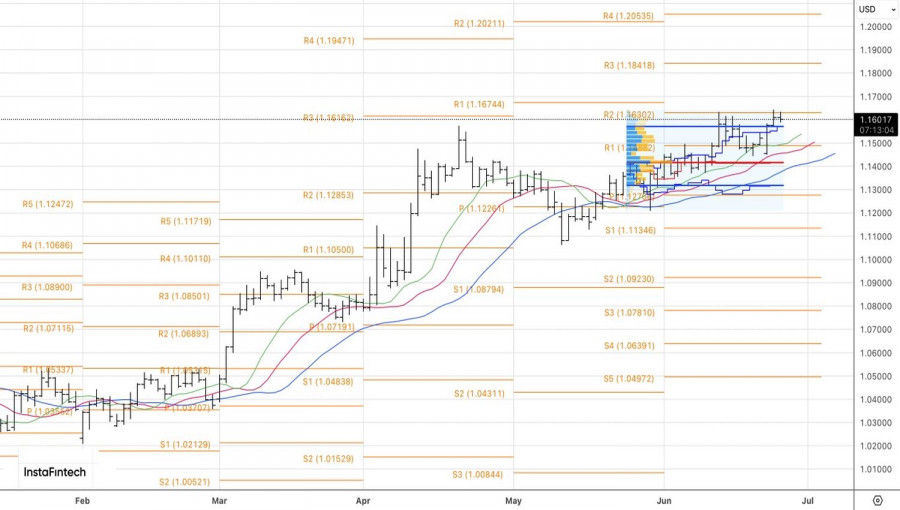

26.06.2025 12:42 AMMarkets were prepared for a ceasefire in the Middle East. But are they ready for the return of trade wars? Investors have come to believe in maintaining a universal import tariff without reverting to country-specific ones. A 10% rate is already significant, but the global economy is gradually adjusting to the U.S. levies. What if Donald Trump surprises everyone in early July by sharply raising the stakes? This uncertainty is preventing EUR/USD from moving higher.

There is little doubt that the eccentric Republican could spring a surprise. Just recall his recent statement that China might be purchasing oil from Iran — which runs counter to Washington's doctrine of cutting Tehran's revenues through sanctions. Still, investors are no strangers to presidential unpredictability. The U.S. president's maneuvers can come at any time. And it seems that markets are overly confident about continuing a universal 10% tariff only.

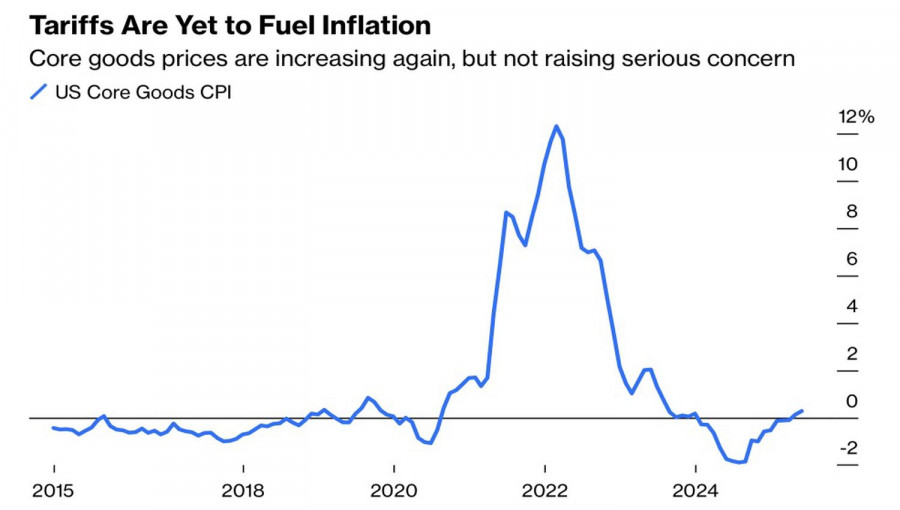

So far, import tariffs have not significantly impacted the U.S. economy. Inflation remains subdued, and employment growth is slowing but still far from alarming levels. Even the contraction of U.S. GDP in the first quarter didn't worry anyone—it was attributed to front-loaded imports and a decline in net exports.

According to Danske Bank, the resilience of the U.S. economy to the shocks of White House protectionism is one of the reasons behind the difficult path of EUR/USD moving north. The bank projects that in the long term, over 12 months, the pair will rise to 1.22. However, in the short term, bulls face serious roadblocks. Alongside strong macro data, these include excessively bearish positioning on the U.S. dollar and ongoing geopolitical conflicts. These factors continue to support the greenback as a safe-haven asset.

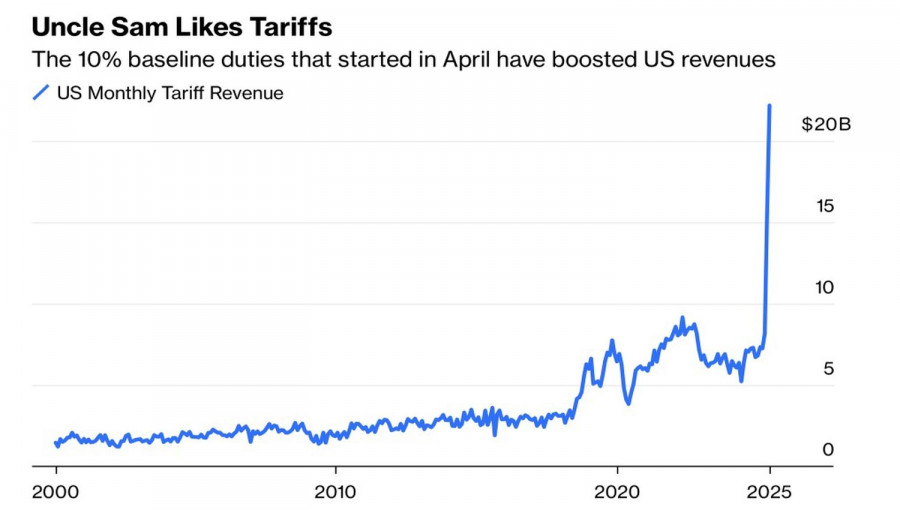

I believe the market's overconfidence in Washington's ability to maintain only a universal tariff could negatively affect stock indices and the U.S. dollar. According to White House Chief Economist Stephen Miran, the U.S. could collect $3–5 trillion from import tariffs over the next 10 years. Alongside economic acceleration resulting from Trump's "big, beautiful bill" tax cut project, this could reduce the budget deficit by $8.5–11 trillion.

These figures are highly optimistic, but they indicate that the U.S. president has no intention of abandoning tariffs. On the contrary, he is very likely to raise them in early July. This would be a shock to financial markets and could spark a wave of selling across U.S. assets, including the dollar.

From a technical standpoint, EUR/USD is fighting for control over the pivot level at 1.1625 on the daily chart. If the bears win, forming a double-top pattern could be a basis for short-term selling. Conversely, a bullish breakout would allow longs to be extended toward a target of 1.20.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.