See also

03.07.2025 12:13 PM

03.07.2025 12:13 PMconsecutive day, once again approaching the yearly high reached earlier this week.The trade agreement between the United States and Vietnam has eased concerns over a prolonged trade conflict, increasing investor interest in riskier assets. In addition, the Bank of Japan's cautious stance on exiting its prolonged ultra-loose monetary policy reduces the yen's appeal as a safe-haven currency. These factors provide a favorable environment for the pair to rise.

At the same time, the euro is struggling to attract buyers due to the relatively restrained rhetoric of the European Central Bank and the moderate strengthening of the U.S. dollar. ECB officials have confirmed that the bank is close to ending its easing cycle, although the possibility of further rate cuts remains open. This stands in sharp contrast to the more hawkish expectations for the Bank of Japan's policy path.

Bank of Japan board member Hajime Takata stated on Thursday that the central bank has only temporarily paused rate hikes and plans to resume tightening after a period of observation. With signs of rising inflation in Japan, this leaves room for further increases, which could limit the yen's weakening and constrain the EUR/JPY pair's upward potential.

The market saw the release of final data on the eurozone services PMI, which came in positive. While the impact of this data on the euro is limited, it still supports expectations for a continuation of the strong upward movement seen in June.

From a technical standpoint, the cross is consolidating ahead of breaking a new yearly high. This is evident from oscillators, which are hovering near the overbought zone.

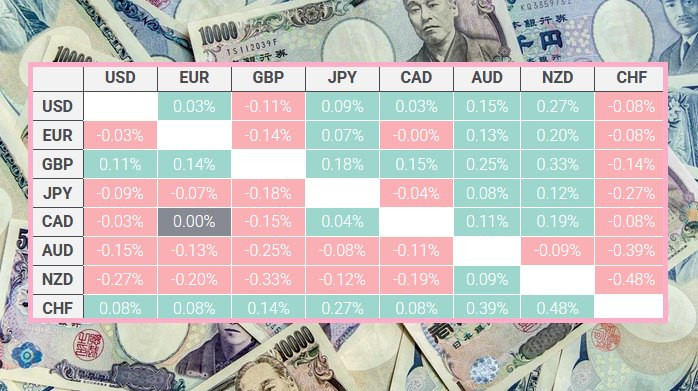

The table below shows the percentage change of the Japanese yen against major currencies today.

The yen has shown the most strength against the New Zealand dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.