Vea también

05.02.2025 10:00 AM

05.02.2025 10:00 AM"To subdue the enemy without fighting is the pinnacle of skill." This is precisely what Donald Trump is trying to achieve. His decision to postpone the 25% tariffs on Mexico and Canada until March 1 allowed the S&P 500 to quickly close its February gap. If investors were frightened, that fear vanished almost instantly.

Once again, greed dominates the stock market, but the real question is—how long will it last? One thing is clear: high volatility is here to stay!

Over the past four years, investors have come to know Trump's tactics inside out. The Republican president is seen as a showman—loudly threatening tariffs, only to cancel them later. But no one expected him to reverse course as quickly as he did in early February.

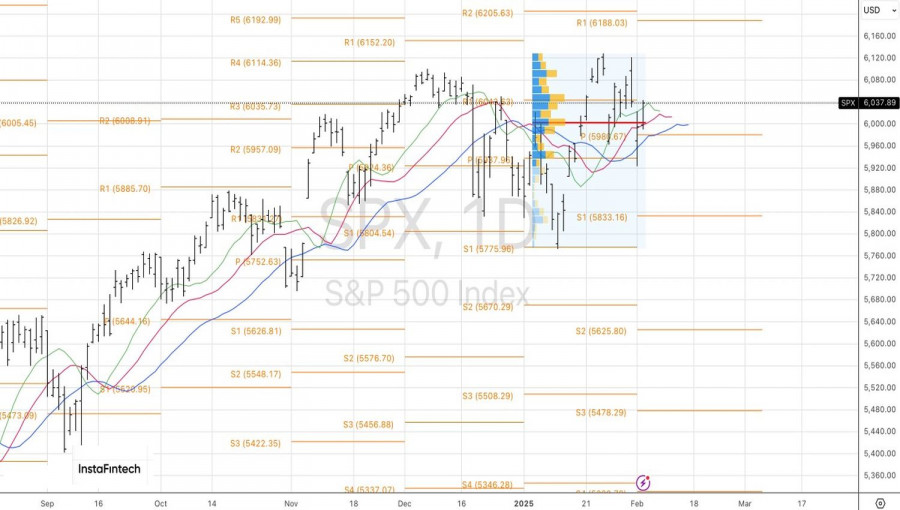

The S&P 500 opened February with a downward gap, only to quickly recover. Given that the index's fundamental valuation remains near record highs, this should surprise no one.

Dynamic of S&P 500 price-to-earnings ratio

Investors need to get used to the rollercoaster ride. For those who believe that Trump's bark is worse than his bite, it might be time to shift focus to assets outside the US, which at least appear less expensive.

However, the risk of prolonged tariffs remains high. The White House sees import duties as a tool to balance US trade, generate additional foreign revenue, and bring manufacturing back to the US. And Trump is starting to wield this weapon.

The real question is how protectionist policies will impact the US economy. During his first presidential term, Trump created a cushion of fiscal stimulus before escalating trade wars. This time, things are different.

Bond market signals stagflation risks

The bond market reacted sharply, indicating a rising risk of stagflation.

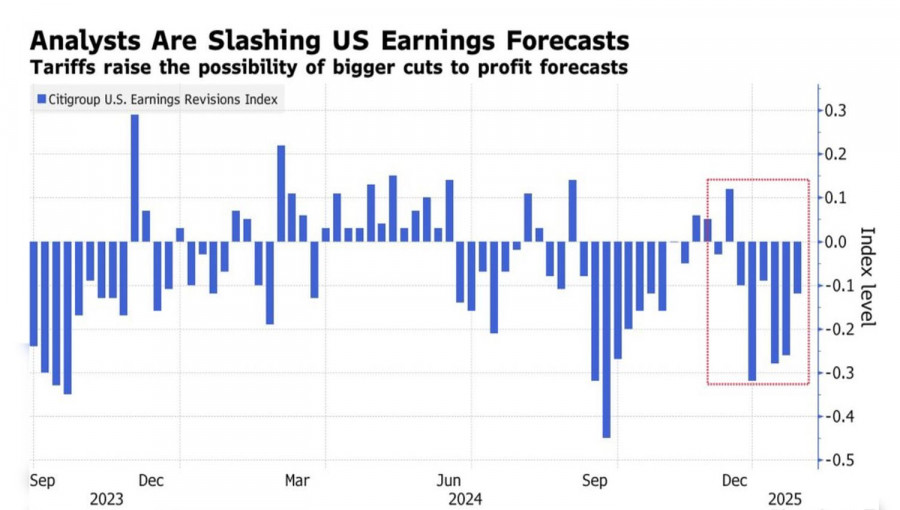

This environment is unfavorable for the stock market. No surprise that Wall Street analysts are cutting earnings forecasts for S&P 500 companies.

Forecasts of S&P 500 earnings

According to Goldman Sachs, even without factoring in tighter financial conditions and changes in consumer and corporate behavior, Trump's tariffs could reduce profit forecasts by 2–3% and increase the risk of a 5% pullback in the S&P 500.

However, if the tariffs haven't been imposed yet, there's nothing to fear. Right? Even the one-day delay in US-China trade talks failed to rattle investors.

For some reason, everyone seems convinced that the 10% tariff against China will be scrapped as well. But isn't it a bit too early to celebrate?

Technical outlook for S&P 500

On the daily chart, the rapid gap closure and confident breakout above fair value signal that bulls have regained control. A successful breakout of the pivot resistance at 6,040 would provide a solid argument for long positions.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.