Vea también

09.05.2025 11:31 AM

09.05.2025 11:31 AMToday, the U.S. Dollar Index (DXY), which tracks the greenback's performance against a basket of major currencies, is in a phase of bullish consolidation after reaching an almost one-month high near the 100.75 level during the Asian session. The index is on track to rise for the third consecutive week and appears poised to continue its recovery after hitting a multi-year low in April.

This week, Federal Reserve Chair Jerome Powell highlighted the high degree of uncertainty surrounding U.S. trade tariffs, urging patience until further clarity emerges. His remarks suggest that the Fed does not plan to cut interest rates in the near term. In addition, the recent trade agreement between the U.S. and the United Kingdom has sparked hopes for similar deals with other nations, which has helped ease recession fears tied to a full-scale trade war. This creates additional support for the U.S. dollar.Geopolitical risks—including the prolonged conflict between Russia and Ukraine, escalating tensions in the Middle East, and disputes between India and Pakistan—also reinforce the short-term bullish outlook for the dollar as a safe-haven asset. However, U.S. dollar bulls remain cautious and are likely to step back ahead of comments from key FOMC members during the North American session. These speeches will be closely analyzed for signals regarding future rate cuts and their potential impact on the dollar index.

Technical Outlook: From a technical perspective, the U.S. Dollar Index remains in bullish consolidation. On the 4-hour charts, the price has successfully broken above the 100-period Simple Moving Average (SMA), indicating emerging upward momentum. Additionally, oscillators on both 1-hour and 4-hour charts have moved into positive territory. However, it is worth noting that oscillators on the daily charts have not yet crossed into positive territory, so dollar bulls should remain cautious.

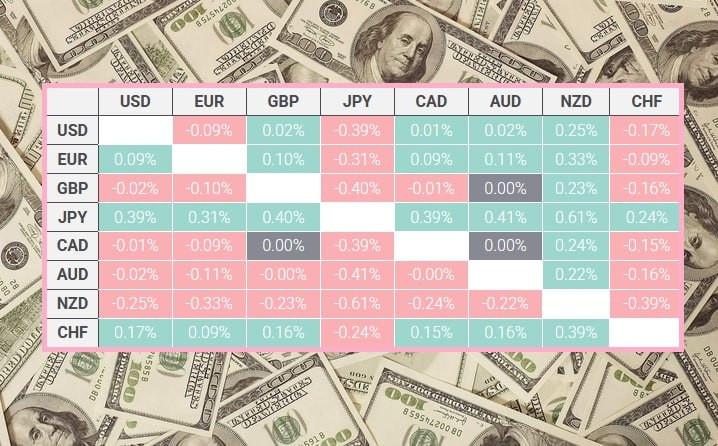

The table below shows today's percentage change in the U.S. dollar relative to the currency basket.

The U.S. dollar was strongest against the New Zealand dollar.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.