See also

06.05.2025 10:16 AM

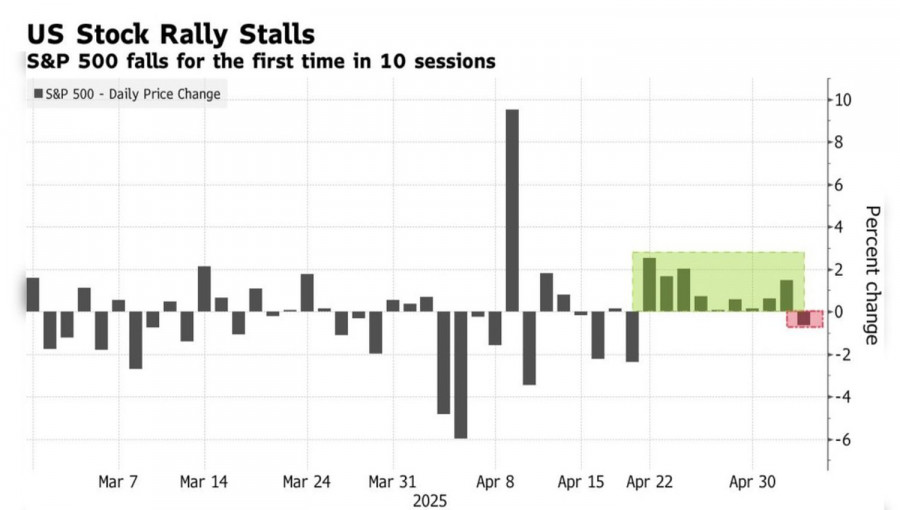

06.05.2025 10:16 AMThe longest winning streak of the S&P 500 in two decades has come to an end. But who's responsible? The Federal Reserve, which plans to keep rates unchanged at its May 6–7 meeting? Or Donald Trump, who has revived tariff threats? The President announced 100% import duties on films produced outside the United States. Investors had seriously expected that the peak of trade policy uncertainty in Washington was behind them, and that duties would only be reduced going forward. Not so fast!

S&P 500 Daily Performance

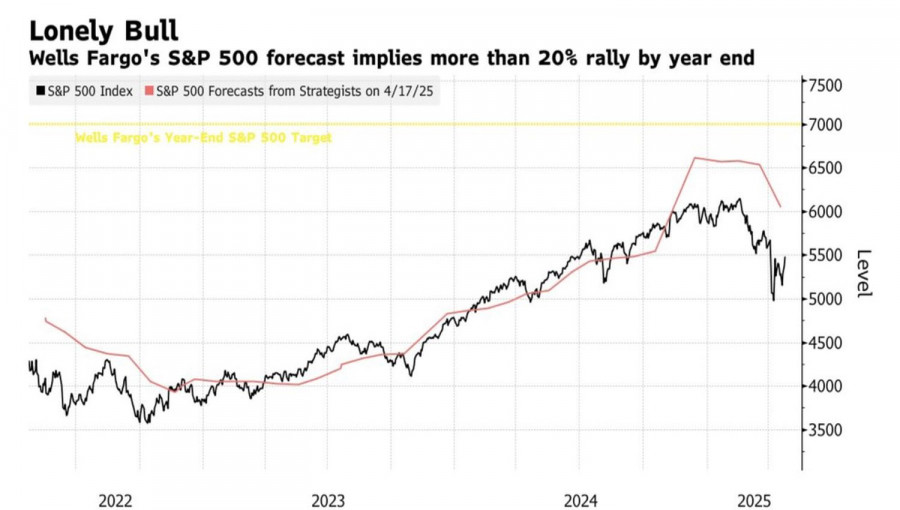

Wells Fargo Securities is banking on that very peak of uncertainty being behind us. The firm is firmly sticking to its forecast for the S&P 500 to reach 7007 by the end of 2025 and remains Wall Street's most bullish forecaster. Fundstrat follows with a target of 6600, and Scotiabank with 6650. The consensus estimate from 29 strategists projects the broad equity index to rise to 5853.

Neither the positive ISM non-manufacturing activity data nor the fiery speeches from White House officials helped the S&P 500. Commerce Secretary Howard Lutnick expressed optimism about the economy and believes Donald Trump will reshape the world. Treasury Secretary Scott Bessent announced trade deals with 17 out of 18 major trading partners and claimed the U.S. remains the primary destination for global capital. The "sell America" strategy isn't worth a dime.

S&P 500 vs. Consensus Forecast for the Broad Index

The faster-than-expected growth in service sector activity is actually being driven by a stagflation scenario. Price components in the PMI rose even faster. If that continues, the Fed's pause in its monetary easing cycle could drag on. Futures markets are confident the federal funds rate will remain unchanged in May and now give only a 27% chance of a rate cut in June — down from 65% just a week ago.

Investors are starting to realize that if the Fed does ease policy, it will only happen against the backdrop of a cooling economy and rising recession risks — a scenario extremely unfavorable for equities.

There is a strong likelihood that by keeping rates steady, the Fed will again face criticism from Donald Trump, whose threats to fire Jerome Powell recently dealt a blow to the S&P 500. The President was even forced to declare, in light of the market crash, that he never intended to remove Powell. Still, the Republican's unpredictability raises the risk of renewed waves of criticism.

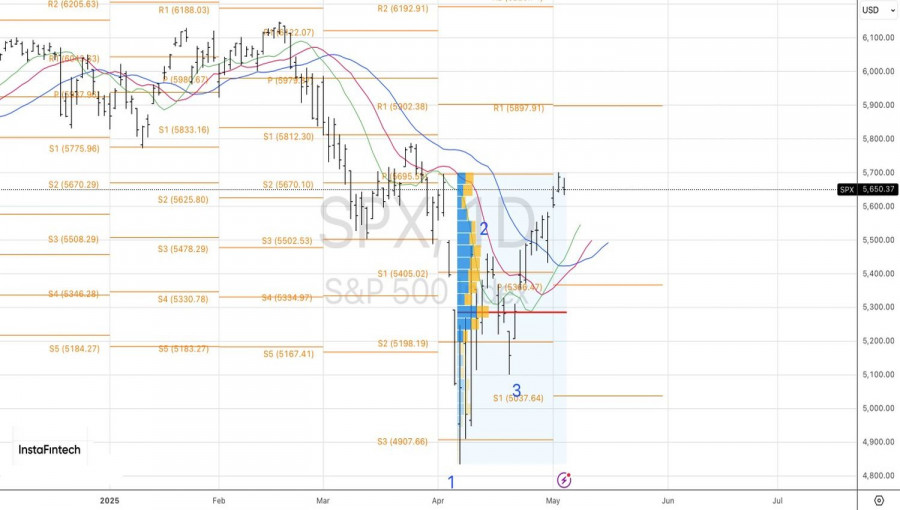

Technical Outlook

On the daily chart, a rejection from the pivot resistance level at 5695 has created conditions for short positions. Although these bearish positions currently look unstable, a drop below 5630 on the broad index would boost sellers' confidence and provide grounds for adding to shorts. It would make sense to return to long positions if the index climbs back above 5695.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.