See also

13.06.2025 09:35 AM

13.06.2025 09:35 AMThe less you know, the better you sleep. Encouraged by a 21% rally in the S&P 500 from its April lows, the crowd continues to buy the dip—completely unbothered by the United States' difficulties in trade negotiations with the European Union, Donald Trump's threats to double the 25% auto tariffs, or the escalation of conflict in the Middle East. Meanwhile, well-informed company executives or insiders close to them prefer to sell stocks. This raises doubts about the sustainability of the uptrend in the broad equity index.

The market has reacted inconsistently to similar inflation data. Initially, the slow growth of consumer prices was seen as a signal of weakening domestic demand and a looming recession in the U.S. economy. The S&P 500 fell. However, after producer prices also came in below Bloomberg experts' forecasts, the broad index unexpectedly rose. The reasons cited included a decline in Treasury yields and an increased probability (up to 35%) of three rounds of Fed monetary easing in 2025.

The market supposedly rejoiced that tariffs hadn't triggered an inflation shock. But the natural question is: who pays the import tariffs? Unlikely foreign suppliers. Unlikely consumers. American companies pay the bills, and shrinking corporate profits is bad news for stocks. Knowing this, insiders prefer to sell equities during market rallies. Their sentiment had dropped to its lowest point since November when Donald Trump won the presidential election.

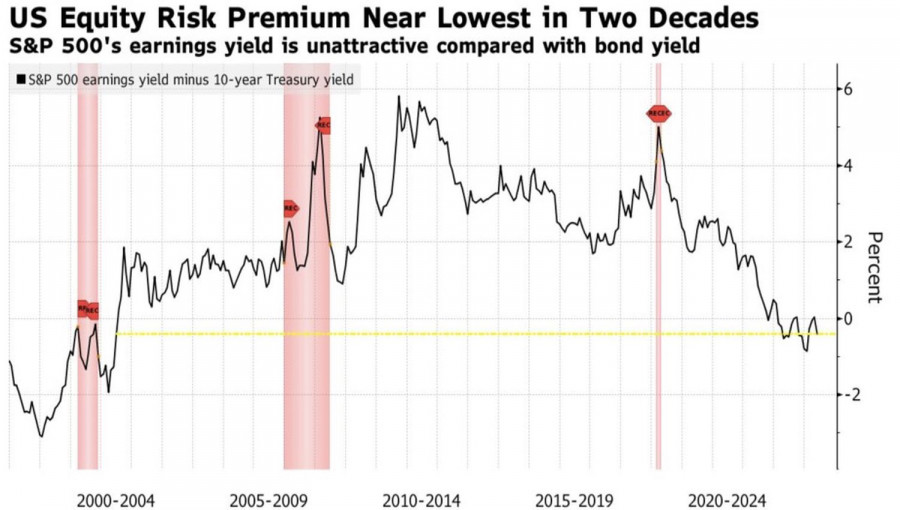

Alongside deteriorating corporate earnings beginning in Q2, investors should also be concerned about the risk premium dropping to its lowest levels since the early 2000s. Investing in Treasury bonds currently looks just as effective as investing in stocks. That's inherently illogical. Equities are riskier assets than bonds. Therefore, stocks are overpriced.

Fueled by crowd greed and the urge to buy the dip, the S&P 500 has climbed too high. Retail investors are inflating a bubble while ignoring negative developments. They only hear what they want to hear: that the worst of the trade wars is behind us, that the labor market is still strong, that the Federal Reserve will cut rates.

Meanwhile, the S&P 500 is ignoring slowing U.S. economic growth, rising recession risks, worsening corporate earnings, overpriced stocks, and potential inflation acceleration due to escalating armed conflict in the Middle East—all at its peril.

Technical Outlook

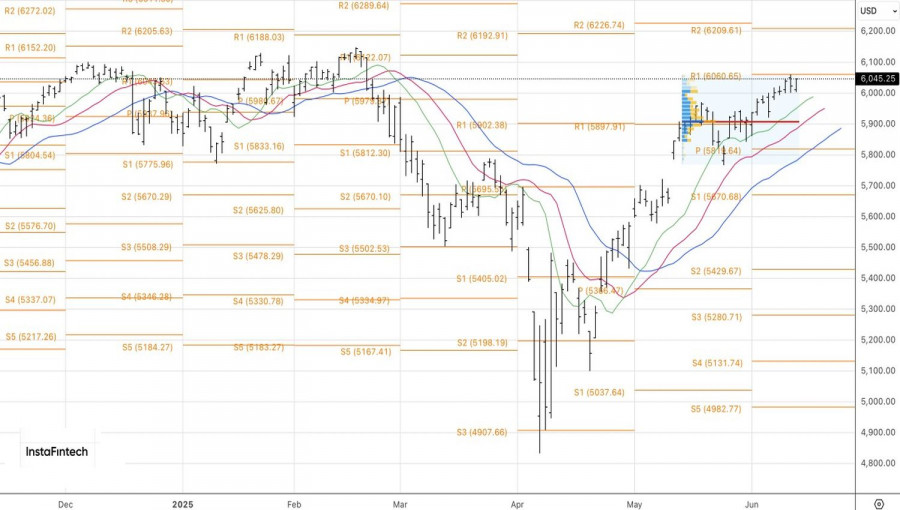

On the daily chart, S&P 500 bulls are trying to push prices back toward the key resistance level at 6060. Failure to break through this level will signal buyer weakness. As long as the broad equity index trades below this level, the focus should remain on selling.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.