See also

28.02.2022 03:45 PM

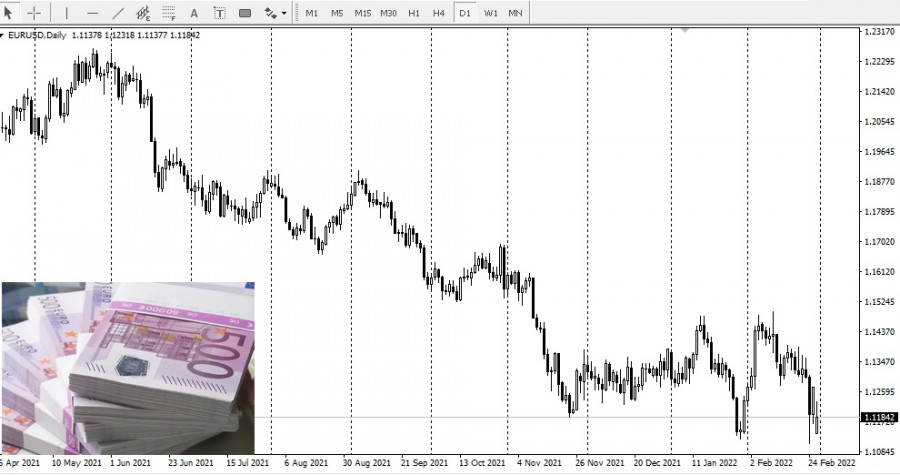

28.02.2022 03:45 PMFrom Luxembourg to New Zealand, global house prices have been rising as economic stimulus has added fuel to a multi-year boom driven by historically low-interest rates.

But at a time when authorities from Auckland to Stockholm have demonstrated that they can use monetary and regulatory levers to curb property prices, the fragmentation of the eurozone into 19 national markets means that the European Central Bank's hands are tied.

According to the International Monetary Fund, five of the 10 countries in the world that saw the largest increase in housing prices in 2020 were in the euro area.

This causes the ECB to worry about a new housing bubble that could cause economic and financial chaos, such as it was in 2008.

Nevertheless, the ECB cannot yet raise interest rates to help some countries in the eurozone, because other countries, such as Italy and Greece, which have the highest debt levels, will have problems. And the Central Bank is trying to avoid a new debt crisis.

The central bank relies on the fact that the governments of countries, often reluctantly, cool the real estate markets with the help of so-called macroprudential instruments, which also have the advantage that they are aimed directly at real estate, and not at the economy as a whole.

They range from forcing banks to accumulate additional capital when issuing mortgage loans to the introduction of extremely unpopular restrictions on the size of mortgage loans depending on the purchase price or the buyer's income.

The problem is that the ECB cannot use this braking method directly and can only warn and make recommendations through the European Systemic Risk Council (ESRB), the body overseeing the financial stability of the European Union.

One of the latest steps of the ESRB, which is based at the ECB and headed by Christine Lagarde, is a call from Germany and Austria to impose restrictions on mortgage loans and raise capital requirements for banks.

But his prescriptions are not mandatory. The German Finance Minister, for example, rejected a recommendation to introduce a loan-to-value ratio for home buyers.

History shows that regulation works according to this principle.

The South Korean authorities were able to slow down the growth of housing prices when they established a debt-to-income ratio in the early 2000s.

And Sweden managed to reduce the cost of housing in 2018, at least for a short time. By requiring homeowners who have taken out mortgages exceeding their family income by more than 4.5 times to pay at least 1% annually.

However, this will also require some unpopular solutions, such as making mortgages almost unaffordable for poorer households.

For example, Germany has just announced plans to use this method a decade after the start of its housing boom, when, according to the Bundesbank, housing prices have already become inflated by 20-35%.

In February, according to the ESRB: Finland and the Netherlands did not take enough measures to restrict mortgage lending, despite its recommendations.

Nevertheless, according to ESRB research, it is clear that monetary policy still matters and can either make macroeconomic regulation more effective if it supports it, or it can surpass it if it works in the opposite direction.

According to some economists, as long as mortgage rates remain below inflation, this makes real estate investments attractive for both households and professional investors.

According to the latest ECB data, in December borrowers fixed the annual interest rate on mortgages at just 1.3% for 10 years, compared with the expected inflation rate of just under 2% for this period.

About Ireland, last year house prices rose by 14.4%, despite the introduction of strict restrictions. Which limits mortgage loans to 3.5 times the gross annual income of the borrower.

Some ECB policymakers suggest that the central bank should pay more attention to housing prices when assessing inflation and setting interest rates, as is the case in New Zealand.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

As I anticipated, the lack of a broad positive outcome in negotiations between China and the U.S. and renewed inflationary pressure led to a sharp decline in demand for corporate

Several macroeconomic reports are scheduled for Friday, but we doubt that the data will significantly impact traders today—especially today. As a reminder, Donald Trump intends to raise tariffs

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.